Taxes

Impacts of the Financial Transaction Taxes for the French Securities Market

Créé le

27.04.2016-

Mis à jour le

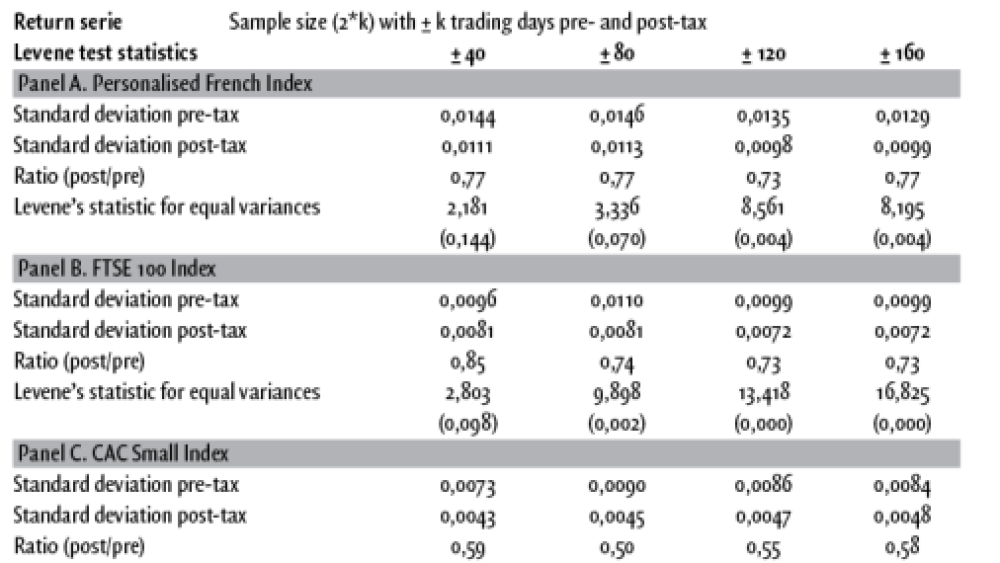

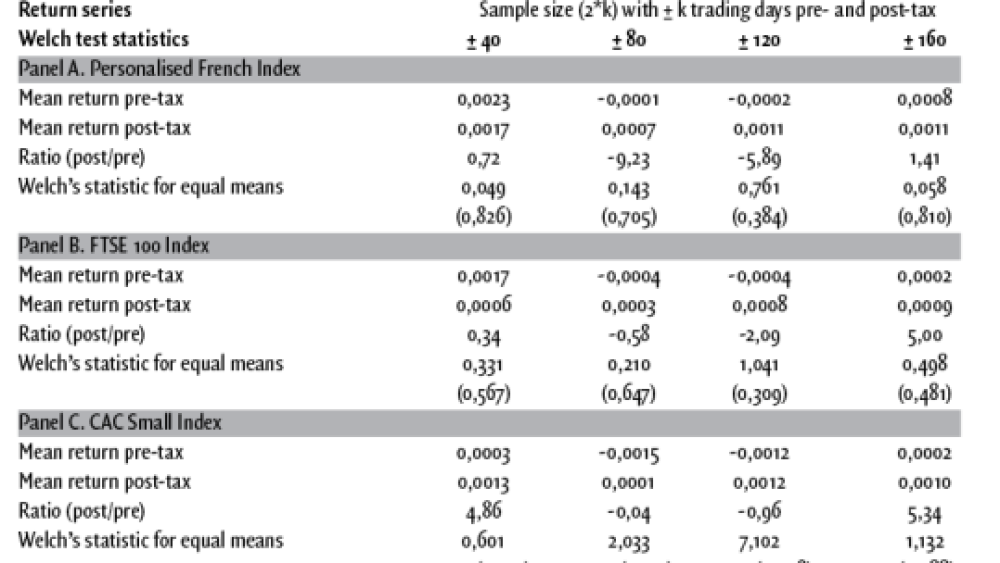

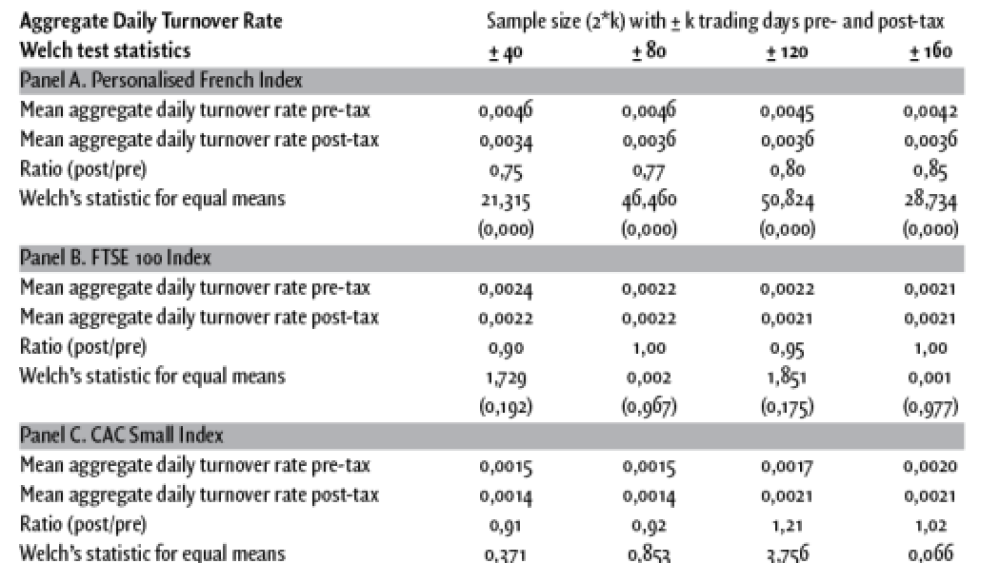

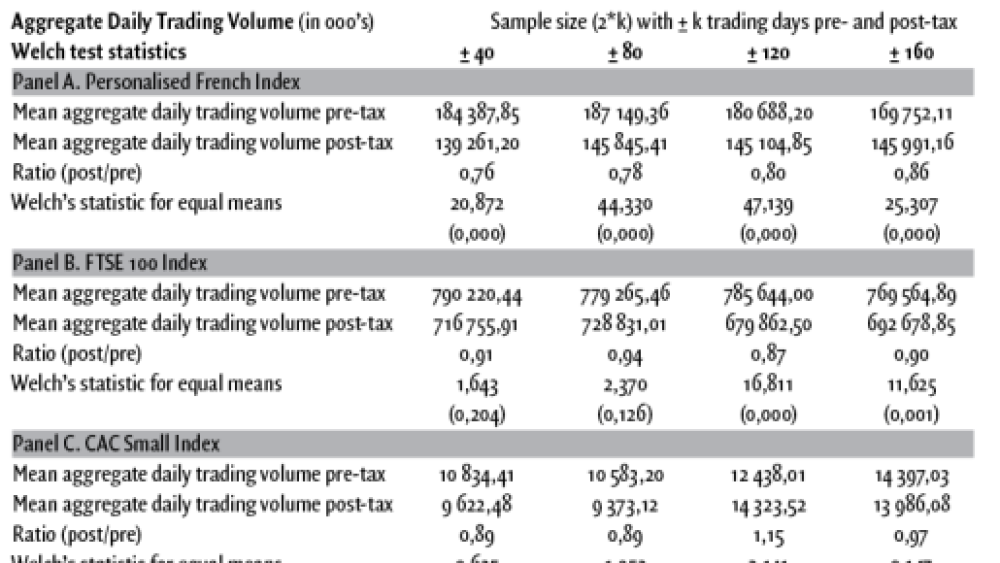

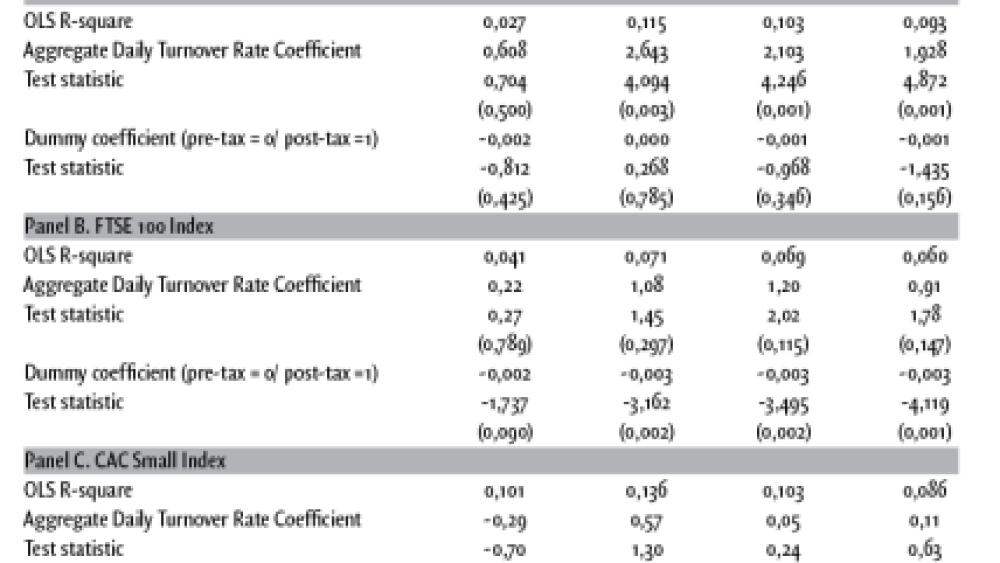

13.06.2016The aim of this paper is to check the influence of the French Financial Transaction Taxe on stock market liquidity, volatility, and efficiency. This mechanism should imply a significant decrease of the volatility and consequently, it should limit stock market speculation. Examining empirically the case of France, the tax is shown to affect market volatility in a significantly negative way.

European policymakers often revisit the still ongoing discussion about a possible financial sector tax. In particular, they evoke a financial transaction tax (FTT) for securities markets, in order to generate revenues from the financial industry. Such transaction taxes have been adopted by several countries already, amongst which are both EU and non-EU members. As compiled by Matheson (2011), proponents of an FTT intend to accomplish clear goals: firstly, to raise revenues from the financial sector, especially to cover the costs of a crisis, and secondly, to reduce speculation by reducing excessive ...