Capital Optimisation under Solvency II

Créé le

25.04.2018-

Mis à jour le

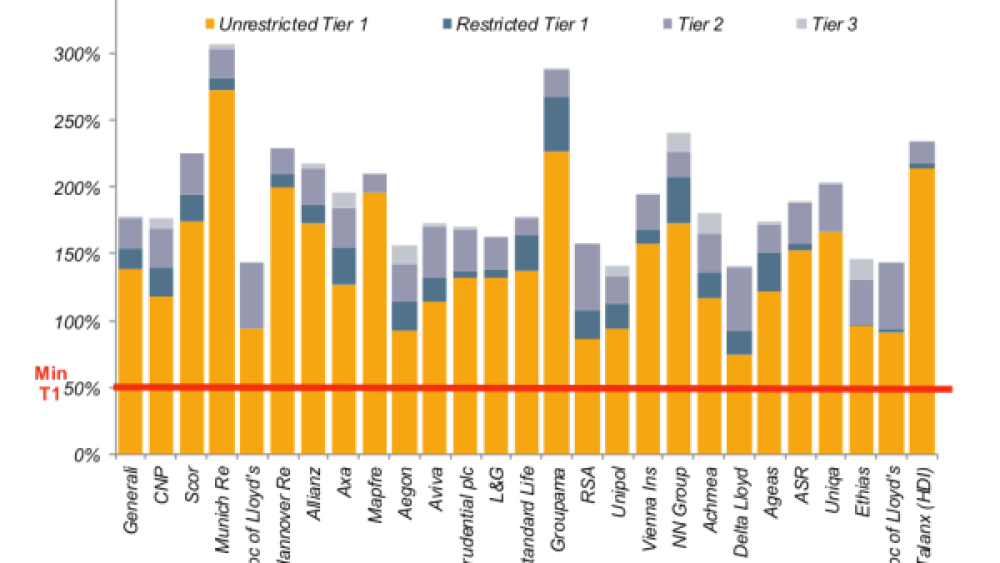

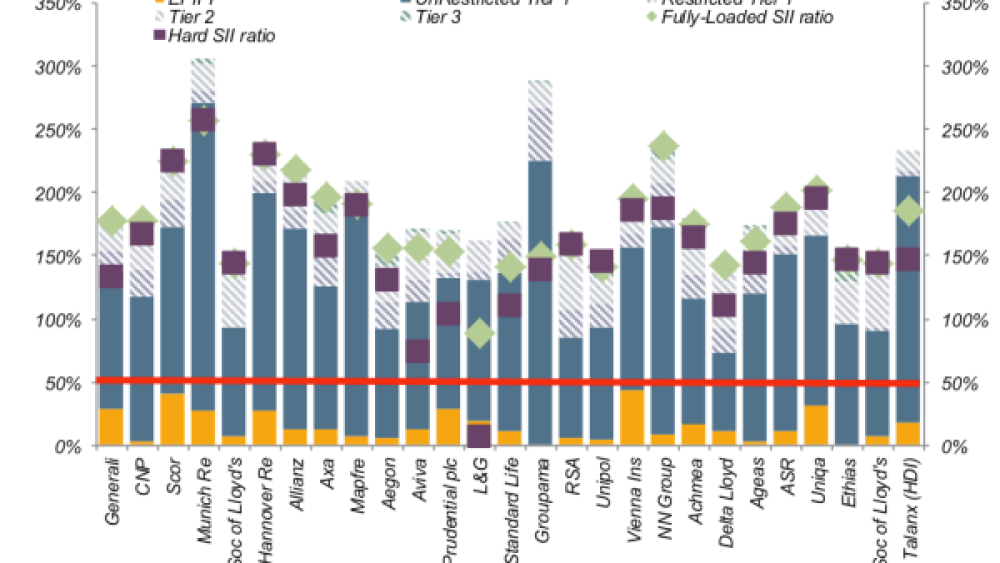

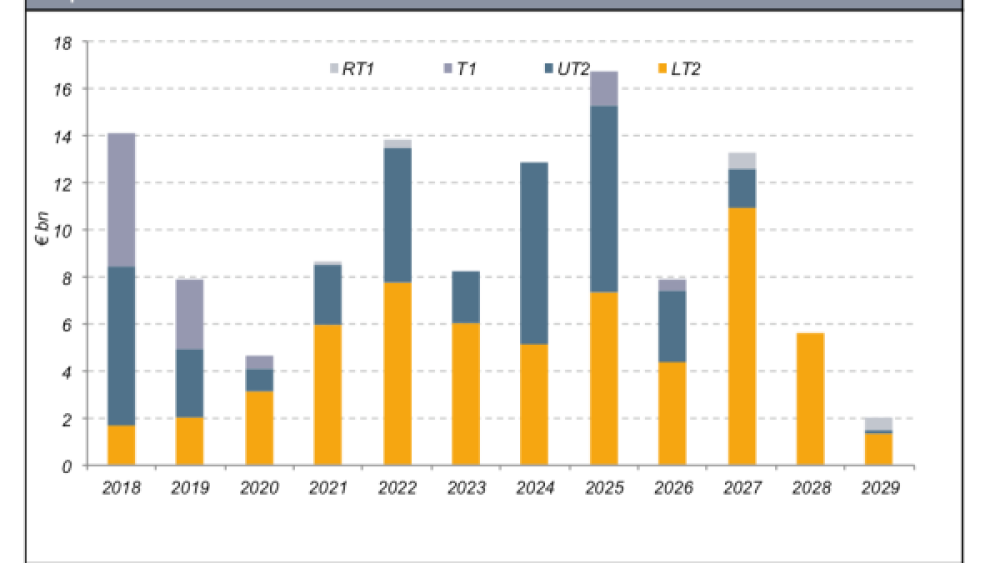

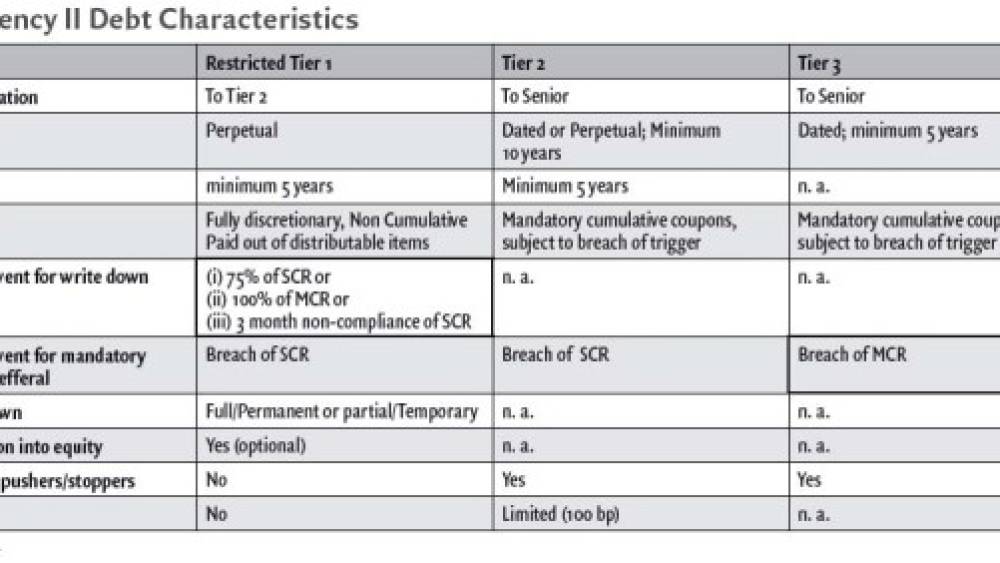

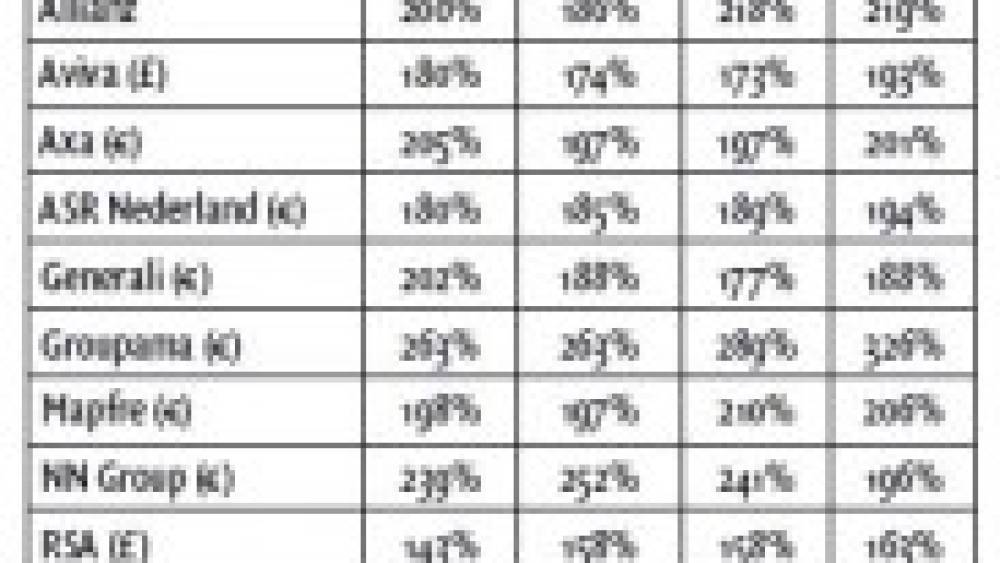

16.05.2018In this article, we analyse the quality of capital of European insurers following the implementation of Solvency II. We fear that the relatively loose grandfathering rules associated with the reliance on soft elements of capital could lead to weakening risk profiles of European insurers.

Since the implementation of Solvency II on 1st January 2016, we have observed a capital optimisation trend among European Re/Insurers. This trend makes sense as the new regulatory framework allows European insurers to rely on soft elements of capital such as expected profit in future premiums (EPIFP), letters of credit issued by banks who, on average, have a lower rating than Re/Insurers and net deferred tax assets. But, paradoxically, due to the economic approach of Solvency II, Re/Insurers will likely increase their reliance on these soft elements of capital while possibly reducing their core ...

![[Web Only] Tarifs bancaires : les banques amortissent l’inflation [Web Only] Tarifs bancaires : les banques amortissent l’inflation](http://www.revue-banque.fr/binrepository/480x320/0c0/0d0/none/9739565/MEBW/gettyimages-968963256-frais-bancaires_221-3514277_20240417171729.jpg)