Innovation

Blockchain and the Nature of Money

Créé le

07.09.2016-

Mis à jour le

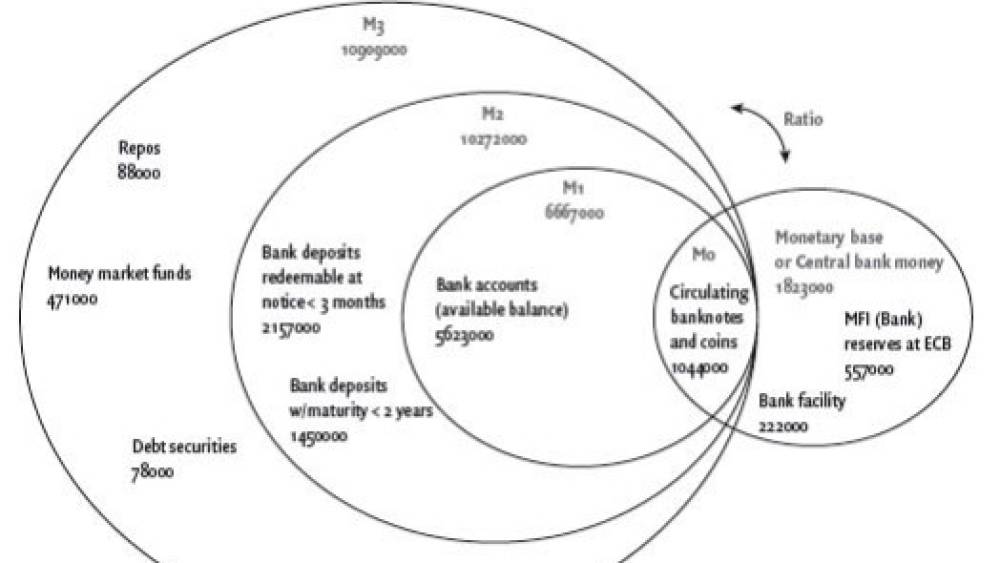

08.09.2016There is currently a great deal of interest in the potential for technologies commonly called Blockchain or Distributed Ledger, to transform many aspects of the world financial system. Many aspects of this technology and much of the enthusiasm/hype began with an attempt to create a new form of currency/payment system called Bitcoin. This paper discusses nature of money in the modern world from the economic, legal and accounting perspectives. It argues that the current nature of money imposes a number of constraints on what can be done with Blockchain/Distributed Ledgers. These constraints will both set the limits on the benefits and ultimately shape the application of the technology. Those trying to build new financial infrastructure without an understanding of these constraints are likely to waste a great deal of effort.

The origins of Bitcoin lay in ideas about what money should be, the future of its underlying technology, Blockchain, will probably be determined by an understanding of what money really is.

Blockchain’s origins lay in the creation of Bitcoin, the currency/payments technology which always had a strong element of ideology in its objectives. Bitcoin attempted to create a world where money (and the payment process) can be free from the inflationary tendencies of governments[1] , the need for intermediaries in the commercial banks, the perceived fraud of money creation by commercial banks and ...

![[Web Only] Tarifs bancaires : les banques amortissent l’inflation [Web Only] Tarifs bancaires : les banques amortissent l’inflation](http://www.revue-banque.fr/binrepository/480x320/0c0/0d0/none/9739565/MEBW/gettyimages-968963256-frais-bancaires_221-3514277_20240417171729.jpg)