Yet, Asian corporate bond markets are still a mixed bag. While the bond markets of Hong Kong, Singapore, Korea, Malaysia and Taiwan are comparatively advanced with outstanding bonds close to or in excess of 50% of GDP, markets in China, India, Indonesia and Thailand are still at an early stage of development. Rapid growth has come particularly from those markets starting out from a lower base. China stands out as having doubled the size of its corporate bond market as a share of GDP over the past four years and is now the largest corporate bond market in the region by USD value. The “more advanced” markets such as Hong Kong, Singapore, Korea, Malaysia and Taiwan have in common a larger volume of outstanding bonds relative to the size of the economy. However, their corporate bond markets vary in terms of their structural characteristics such as composition by currency, sector, company characteristic and use of funding.

Asia’s corporate bond issuance tells a tale of many markets

Asian (non-financial) corporate bond markets are characterized by a high proportion of bonds denominated in local currency. With 83% of corporate bonds issued in local currency in 2009-13, the share is significantly higher than in other emerging market regions. For example, in Latin America local-currency issuance accounted for only 28% of firms’ bond issuance in the same period. However, the share of local-currency bond issuance started to decline in recent years across Asia. The share of foreign-currency denominated bonds rose from below 15% in 2008-09 to more than 20% in 2013. In Indonesia and Hong Kong, where foreign-currency issuance dominates, the increase over the past year was less strong. However, the Philippines, India and Taiwan have seen a large increase in the share of foreign-currency denominated issuance during 2013. In a context of low interest rates in global markets, borrowing in USD offered a cheaper source of funding relative to borrowing in local currency (which was additionally often not available for smaller issuers). Lower debt-servicing costs have thus propped up firms’ ability to take on foreign-currency denominated debt.

Bond issuance by Asian firms is often dominated by a handful of players – a limitation that highlights why corporate bond markets are considered still in their infancy in many countries. In the Philippines, Taiwan and Indonesia, the ten largest issuers were responsible for more than 80% of total bond issuance in 2013. By sector, corporate bond issuance has been concentrated in mining and utilities, construction and the transport sector. In addition, the financial sector accounted for one-third of the bonds issued in 2009-13 (otherwise not included in the figures stated in this article). In China, construction and real estate companies have become key drivers of the issuance boom, increasing their share in total issuance to 24% in 2012-13 from 16.7% in 2010-2011. In Hong Kong, this sector accounts for 37% of bonds issued in 2009-13. Indonesia’s corporate bond landscape is dominated by mining and utilities firms, which issued more than half of all bonds in 2009-13.

Public placements in the domestic market accounted for the lion’s share of corporate bond issuance in China, Malaysia, the Philippines and Korea in 2013. Yet, with the cost of borrowing a primary determinant of firms’ financing mode, private placements are still common given the high regulatory costs associated with public issuance. In India, for example, more than 80% of the corporate bonds issued domestically in 2012 were through private placements. China’s regulator initiated a pilot scheme for private placement of SME bonds in 2012, in a move to stimulate development of the bond market and reduce SME’s reliance on bank loans.

As the bonds issued in the recent funding wave mature, more debt is expected to be needed for refinancing and repayment purposes in the coming years. Of the corporate bonds outstanding in the region as of end-2013, some USD 1.4 tr are scheduled to mature by 2020, with Chinese debt representing the largest share.

The flipside of Asia’s strong corporate bond expansion is increasing leverage, which can give rise to financial stability concerns, particularly if borrowing is at short maturities or in foreign currency. Non-financial firms’ borrowing through bonds and loans has risen markedly above 100% of GDP in China and Hong Kong, although in the case of Hong Kong this is partly due to the large amount of loans intended for use offshore, a special feature of its role as an international financial centre. In contrast, in Korea, the corporate credit-to-GDP ratio at 111% has been little changed over the last few years, after rising sharply until 2008. In Thailand, Singapore and India, corporate borrowing through loans and bonds as a share of GDP is less than 80% of GDP. Indonesia has the lowest corporate credit-to-GDP ratio at just 19%. But corporate indebtedness has been growing at a rapid pace in many countries. The fastest expansion was registered in China, where credit to non-financial firms grew at a compound annual growth rate (CAGR) of over 22% in the past five years. India’s and Indonesia’s companies became more indebted at a similar rate, albeit from a lower level.

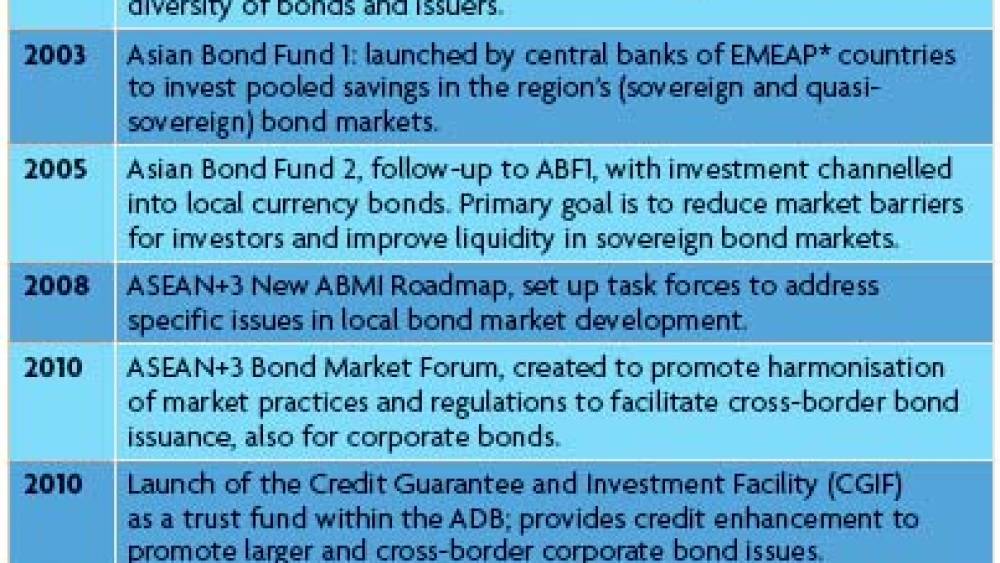

Developing corporate bond markets remains a work in progress

Notwithstanding the recent surge in firms’ bond issuance, the development of corporate bond markets in Asia is far from complete. In the past, policy initiatives have successfully contributed to propping up local sovereign bond markets in Asia but only a few have targeted corporate bonds. Some of these policy initiatives have been helpful in, for example, encouraging the issuance of locally rated or unrated debt. The Credit Guarantee and Investment Facility (CGIF) – a trust set up in 2010 by ASEAN+3 (China, Japan, Korea) and the Asian Development Bank (ADB) – provides guarantees for bonds issued by firms facing constraints in securing long-term funding from the local bond market. Another example is Thailand’s Securities and Exchange Commission (SEC) which began to allow the sale of unrated bonds to accredited investors. The larger role played by local rating agencies has also facilitated firms’ access to the bond market in countries such as China, India, Korea, Malaysia and Thailand.

Nonetheless, given the rapid growth in corporate bond markets, localized efforts are unlikely to be sufficient. More is needed to build a framework that is both conducive to market innovation and enables companies to seek funding from a broader range of sources. Across many Asian markets, new corporate issues are typically traded only for few days and trading volume in secondary markets is low. Asia’s corporate bond markets have grown to an extent that requires increasingly concerted efforts to upgrade supporting market structures such as standardised credit rating systems, risk management products and a functioning legal and regulatory framework. Improvements in the legal infrastructure would also be essential to help the development of a repo and derivative market.

In China’s fast growing corporate bond market, implicit government guarantees and an underdeveloped framework for pricing risks have shielded many corporate issuers in the past. However, as China’s capital markets develop and a wider group of issuers participate, sound risk management and adequate pricing mechanisms become more important. By allowing the first-ever default in the onshore corporate bond market at the beginning of 2014, China has demonstrated its willingness to advance towards a healthier market.

Transparency and availability of information are crucial pre-requisites for prudent risk management which in turn enables greater financial innovation. Policy steps in that direction include Hong Kong’s and Malaysia’s launch of a pilot platform for cross-border clearing and settlement of debt securities in 2012, aimed at strengthening post-trading infrastructure and promoting standardisation and dissemination of corporate announcements across Asian markets.

Corporate bonds are just one component in the funding mix for non-financial companies, be it small and medium-sized enterprises or large conglomerates. Bank lending remains the dominant source of financing for companies in Asia. Here, bank-based financial intermediation has a traditionally strong position, as it can draw on the region’s sizeable pool of domestic savings. But the domestic corporate bond market is definitely on the rise as an additional source of financing for businesses in the region, reducing the reliance on public-sector funds and fuelling economic growth.

![[Web Only] Tarifs bancaires : les banques amortissent l’inflation [Web Only] Tarifs bancaires : les banques amortissent l’inflation](http://www.revue-banque.fr/binrepository/480x320/0c0/0d0/none/9739565/MEBW/gettyimages-968963256-frais-bancaires_221-3514277_20240417171729.jpg)