Prospective

Consequences of Brexit on Insurers

Créé le

02.11.2016-

Mis à jour le

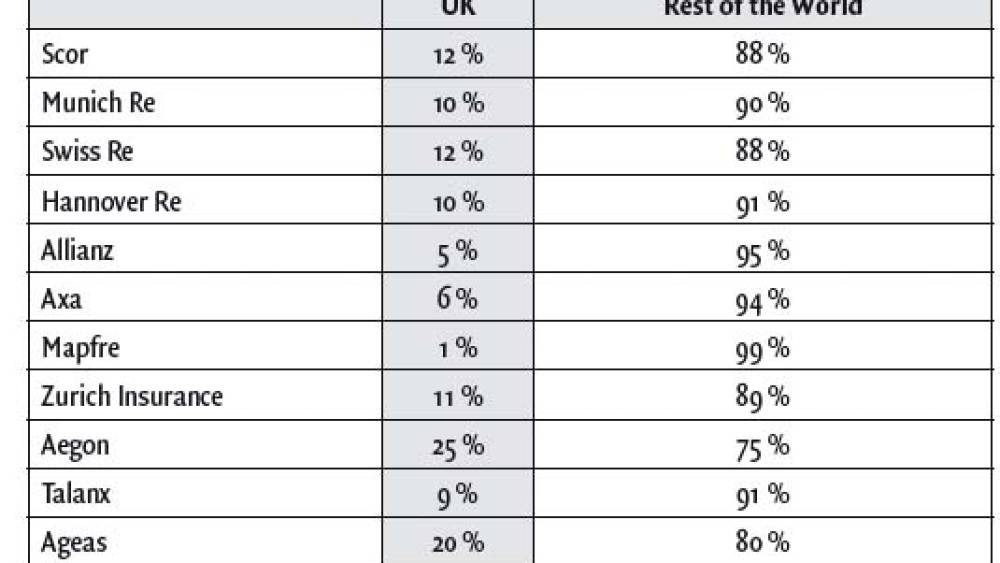

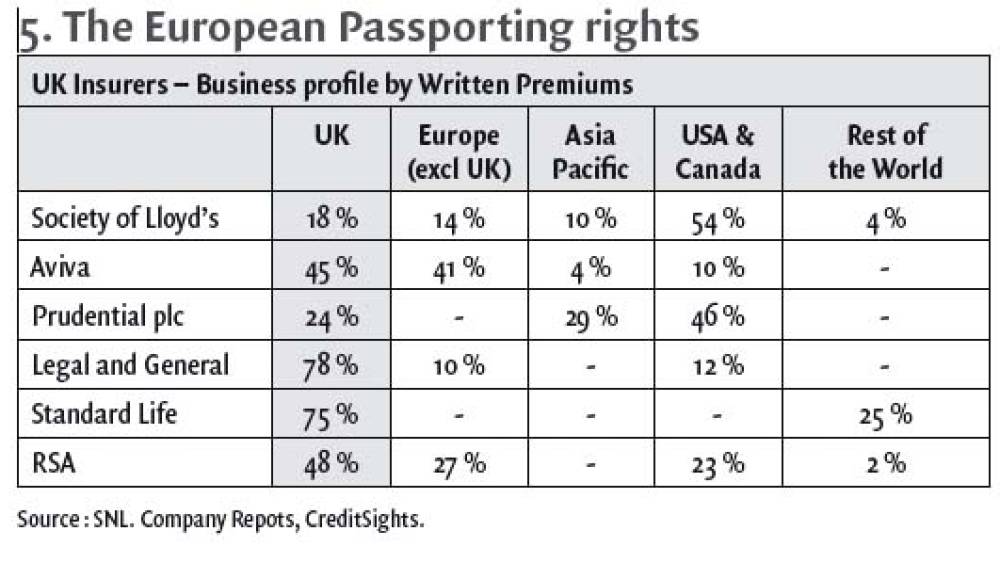

06.09.2017Les assureurs européens et plus encore britanniques doivent-ils s’inquiéter du Brexit ? Tout dépend de leur exposition à la livre, de la part de leurs activités au Royaume-Uni et de leur ratio de solvabilité actuel, celui-ci étant sujet à une plus forte volatilité. Mais, au global, l’impact devrait rester limité par rapport à celui sur le secteur bancaire.

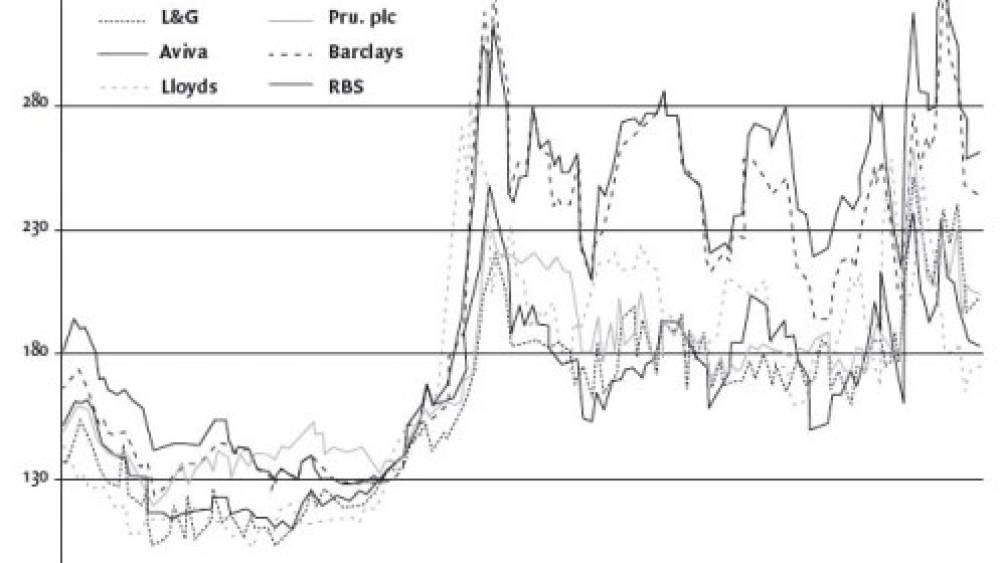

Brexit will likely have limited impact for UK insurers. Our rationale is based on the strong resilience of insurers to a potential slowdown in the economy because of the compulsory nature of most insurance products and the limited impact on the potential fall in value of their investments (in particular for Life insurers). During the financial crisis of 2008 to 2010, the insurance sector demonstrated its resilience to the financial crisis because of the insurers' strong levels of liquidity. In the article below, we highlight five risks as a consequence of Brexit: (i) a weaker demand for insurance ...