Strategy

Is Private Equity a victim of its own success?

Créé le

08.11.2017-

Mis à jour le

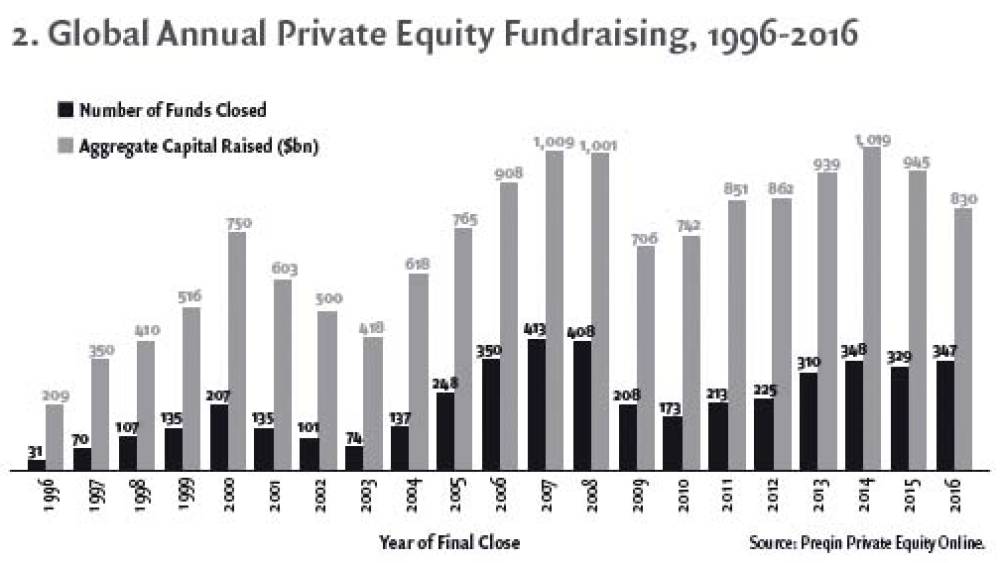

13.12.2017Les performances à deux chiffres des fonds et l’abondance de liquidité actuelle dopent la collecte du capital investissement. Mais le modèle qui a fait le succès de cette industrie ces trente dernières années peut-il supporter une telle montée en charge ?

Private Equity has been part of the investment landscape since the middle of the 20th century. It consists in investing in non-listed companies or in public ones to then delist them. It is a complex industry that has several unique characteristics:

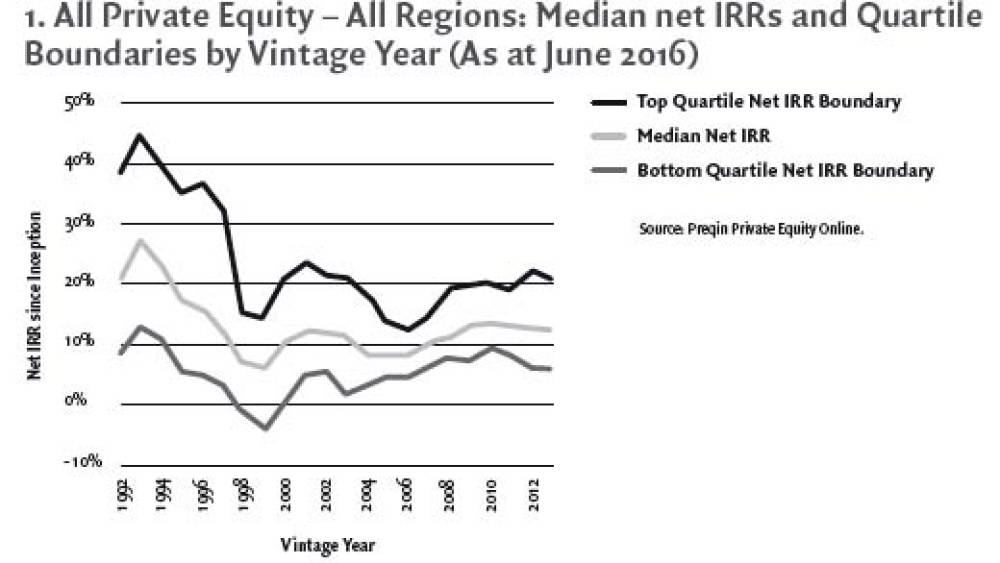

It invests in non-listed companies, is not market-correlated and has performed consistently in the last thirty years;

Funds have several participations, which makes them diversified assets;

Investments last between 5 to 7 years and investors commit money to a fund that lasts in average 12 years which makes the asset illiquid; Debt is often used in structuring ...