Regulatory Reporting Business Services

A New Approach to Regulatory Compliance

Créé le

10.03.2014-

Mis à jour le

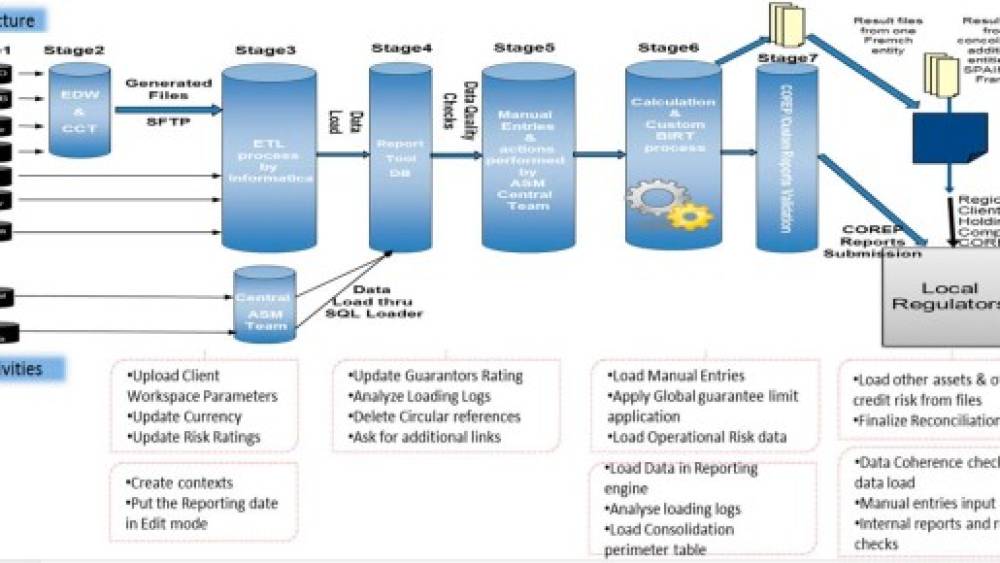

26.06.2014Banks should automate the production of regulatory reportings to be able to achieve regulatory compliance at a reduced cost and on time. Regulatory reporting factories can thus be built on an end-to-end model, including technology componentry, date re-use and transformations.

Since the 2008 ‘financial crisis’, regulators in virtually every jurisdiction have significantly ‘upped the ante’ in terms of levels of disclosure, granularity, traceability and frequency of regulatory reporting requirements. This ‘quantum leap’ in standards has caused significant headaches for a number of firms, with issues like data quality, data adequacy and enrichment, functionality and lineage as key areas where capabilities have needed to be enhanced significantly. In many cases, these types of resources are very scarce in any single bank, ...

![[Web Only] Tarifs bancaires : les banques amortissent l’inflation [Web Only] Tarifs bancaires : les banques amortissent l’inflation](http://www.revue-banque.fr/binrepository/480x320/0c0/0d0/none/9739565/MEBW/gettyimages-968963256-frais-bancaires_221-3514277_20240417171729.jpg)