Statistical analysis

The Impact of Macroeconomic and Financial Indicators on Long-term Issuer Ratings

Créé le

05.12.2016-

Mis à jour le

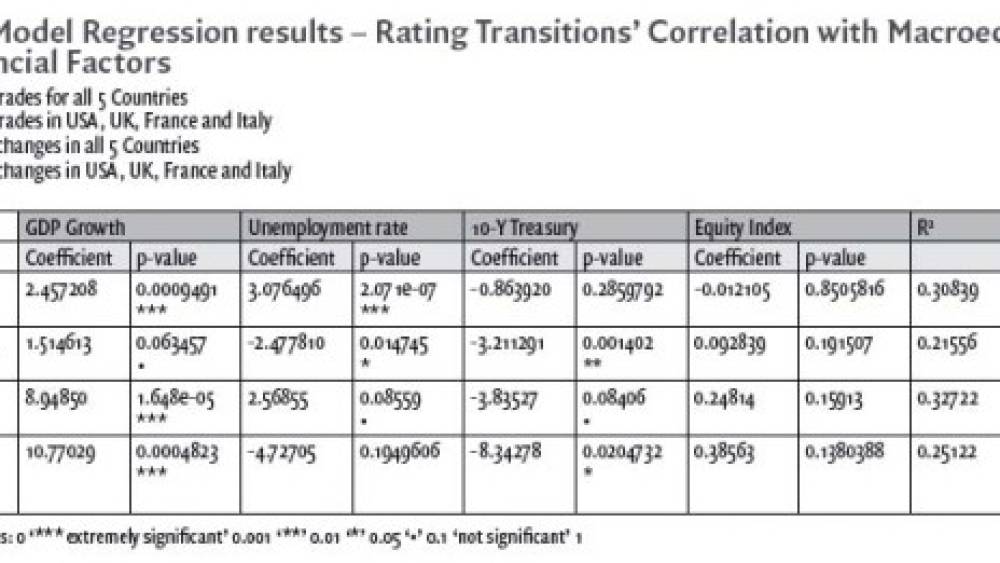

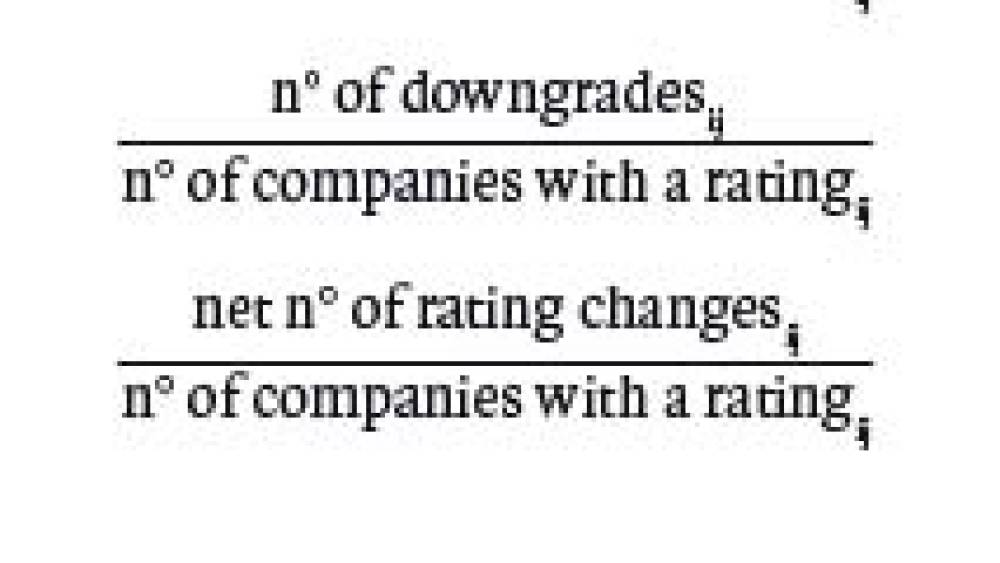

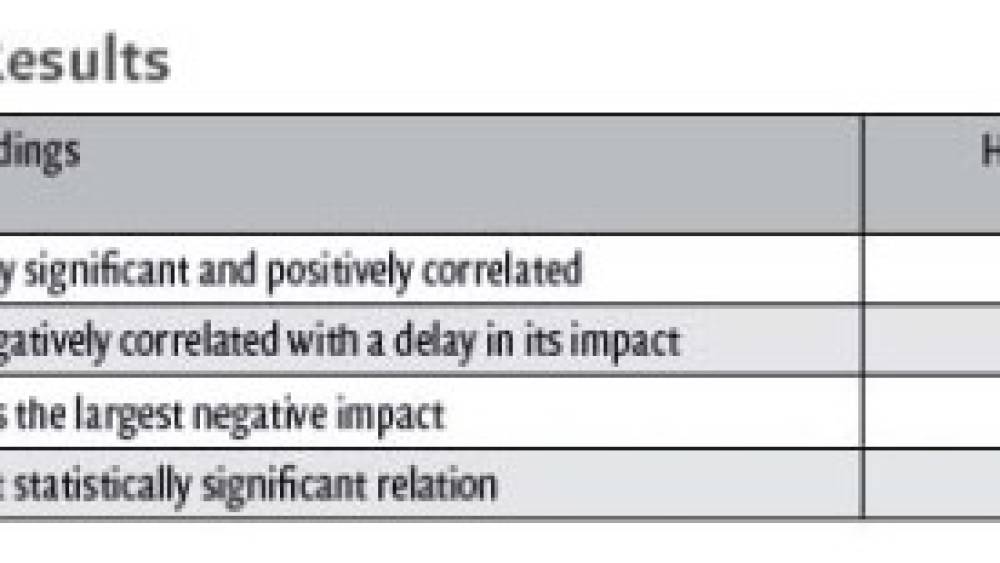

13.12.2016Une analyse statistique de l’influence de facteurs macroéconomiques (croissance du PIB, taux de chômage…) et financiers (rendement des taux à dix ans, indices actions…) sur les changements de notes de cinq pays – États-Unis, Royaume-Uni, France, Italie et Grèce – conduit à conclure que ces facteurs ont certes une incidence sur les évolutions des notations, mais que celle-ci plus ou moins significative.

The relation among macroeconomic and financial fundamentals and the rating activity has been widely explored in the last 15 years.

Literature review

The first time it has been demonstrated that rating transitions vary according to the business cycle has been in the 1990s, with several studies[1] examining rating transitions matrixes’ changes face to changes in the environment, to conclude that the hypothesis that ratings are sensitive to several external factors was validated. In 2000 Nickell, Perraudin and Varotto demonstrated that: (i) lower-rated issuers proved were significantly more ...