Investment Strategy

Cushioning Market Volatility: Robustness for All Seasons

Créé le

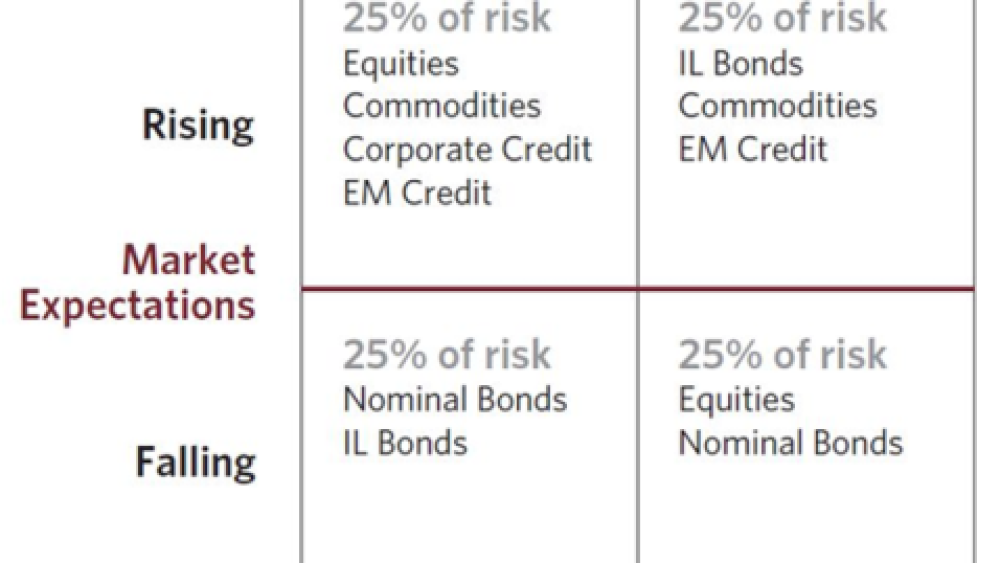

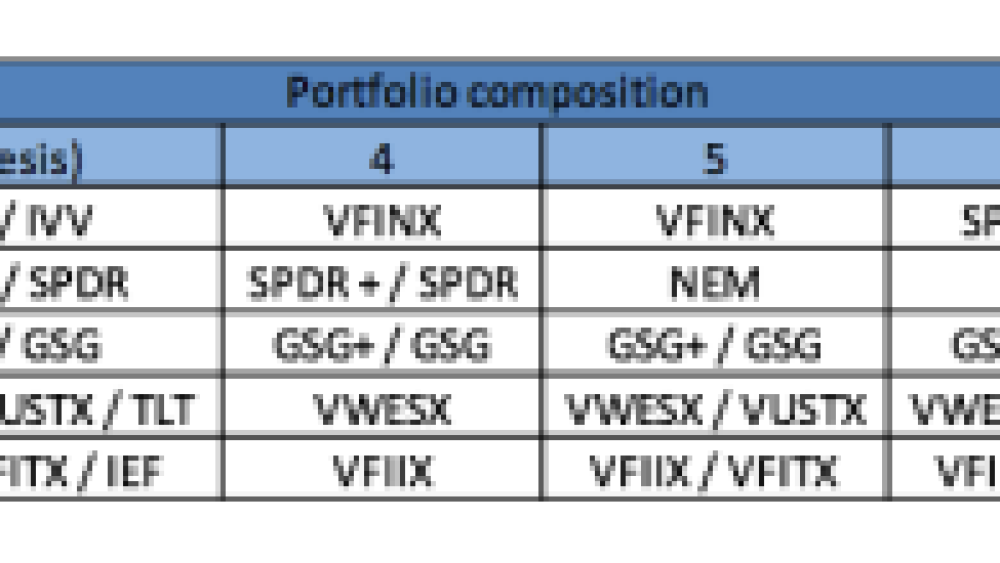

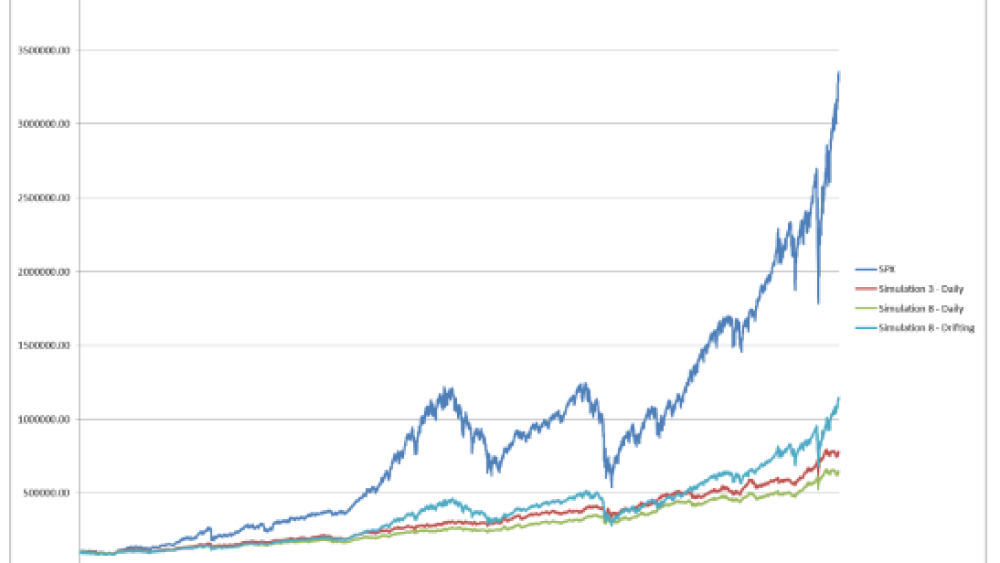

28.06.2021In a world of inflation uncertainties, outsized Fed influence on market behaviour, and wild gyrations in crypto-assets, certainties are in shorthand. Therefore, more than ever, there is a need for strong and stable investment strategies, which have withstood the test of time and shown that a steady and sheltered return on investment is achievable. It is such a portfolio which is the subject of the present study.

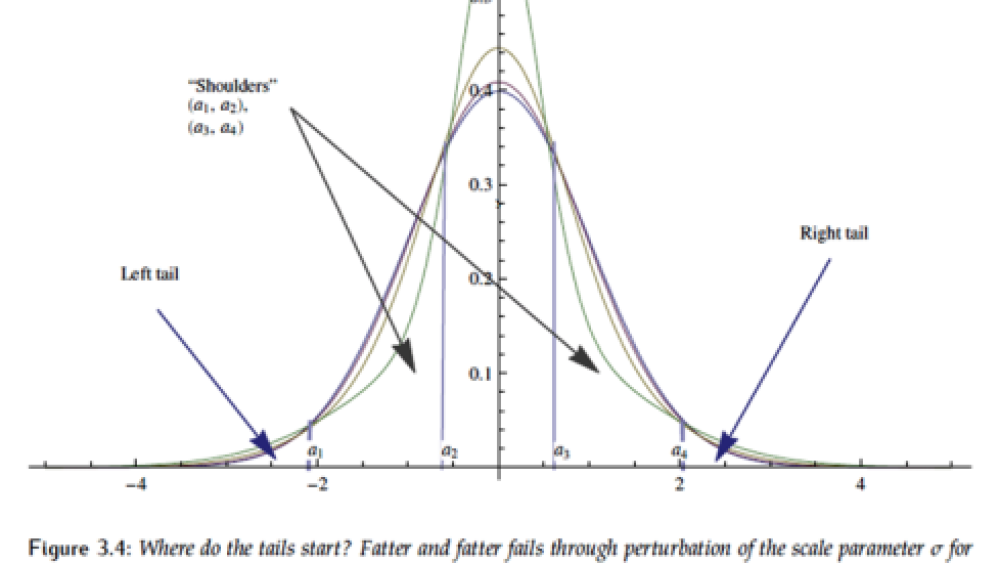

Over the last decades, the volatility of financial markets has gradually increased, returning to levels often seen in the 19th and early 20th centuries, from the onset of modern bourses up to the initial shocks of the Great Depression in 1929. The present increase in volatility was coming after several decades of calmer waters, induced by the New Deal regulations and compounded by the effects of the 1945 economic post-war settlement. Coincidentally, most of what is now known as classical financial theory was established during those decades of calm.

A conflict of facts and theories

Considering ...

![[Web Only] Tarifs bancaires : les banques amortissent l’inflation [Web Only] Tarifs bancaires : les banques amortissent l’inflation](http://www.revue-banque.fr/binrepository/480x320/0c0/0d0/none/9739565/MEBW/gettyimages-968963256-frais-bancaires_221-3514277_20240417171729.jpg)