Hybrid capital securities

Contingent Capital Instruments: pricing behaviour

Créé le

31.05.2016-

Mis à jour le

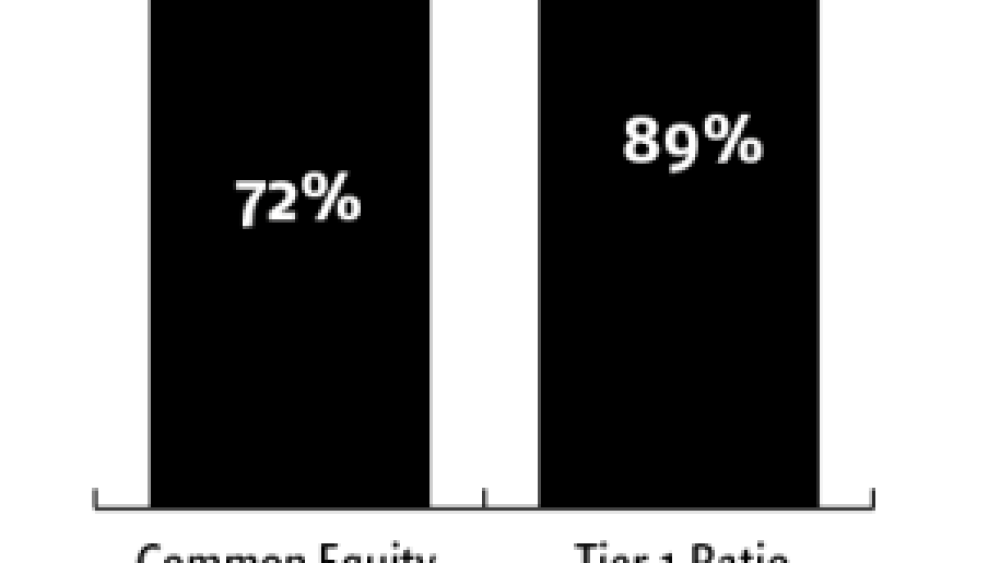

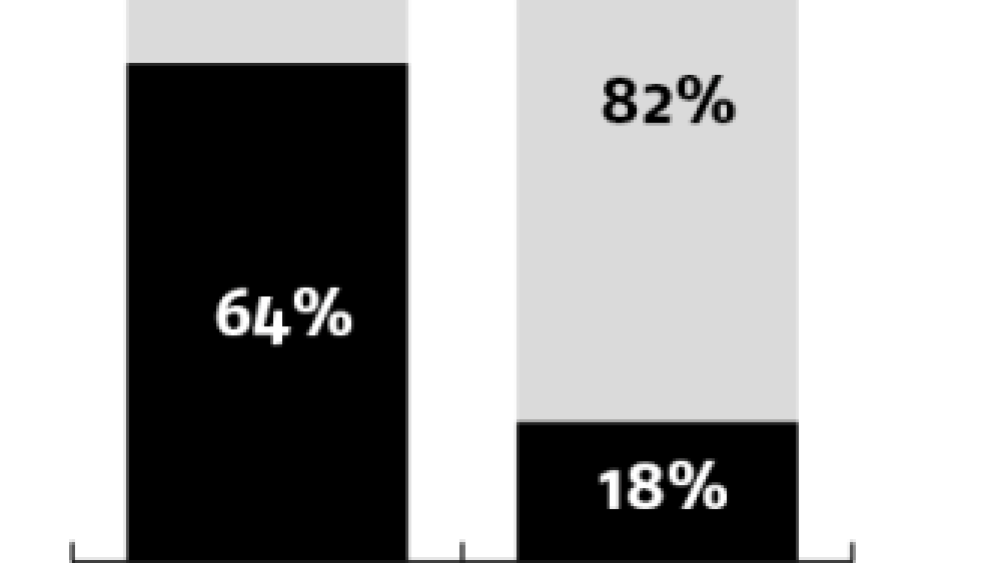

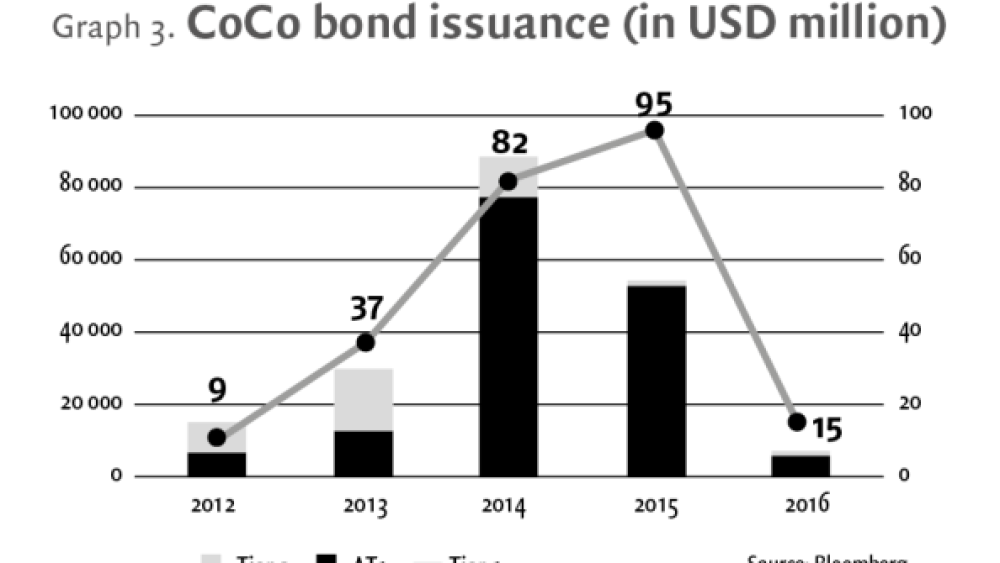

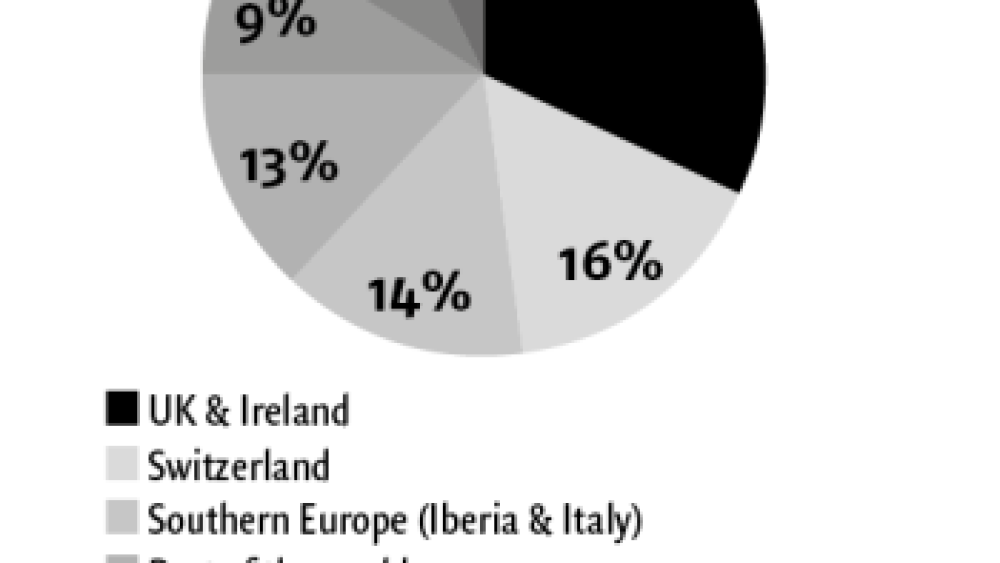

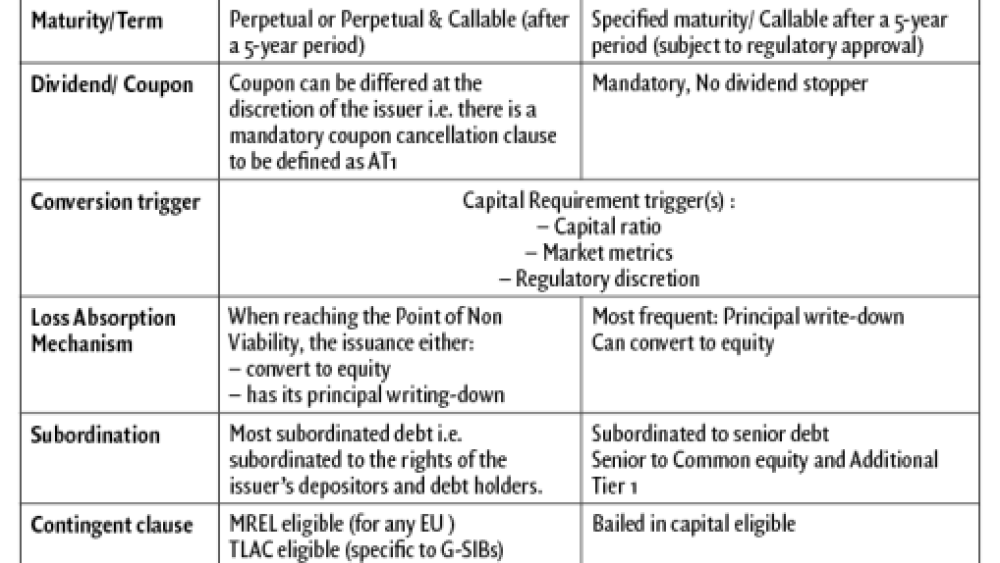

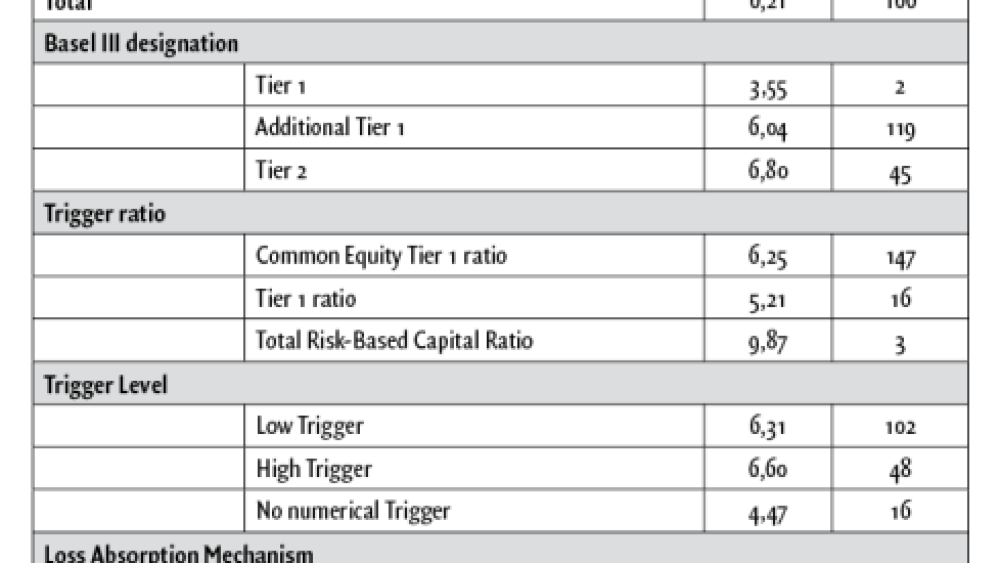

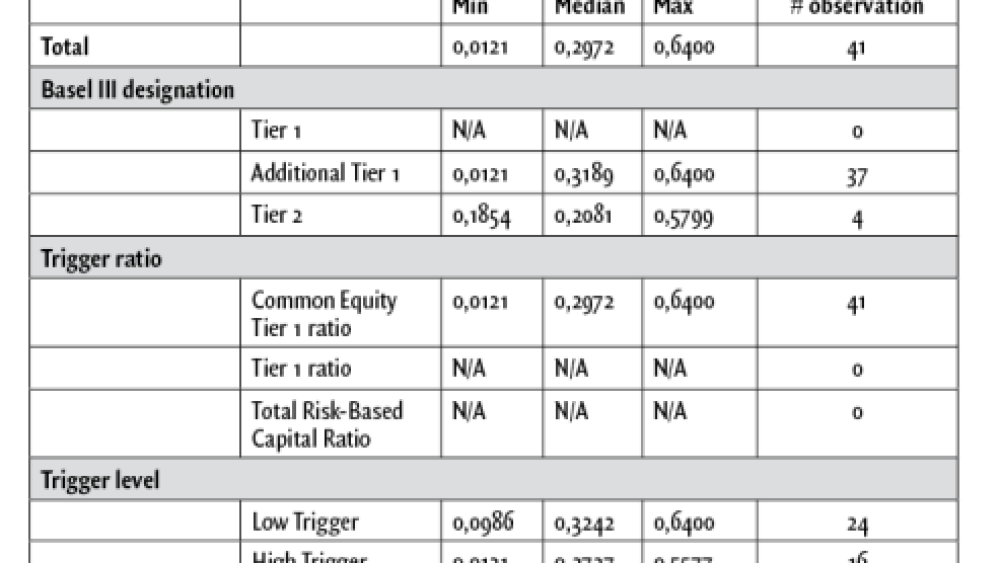

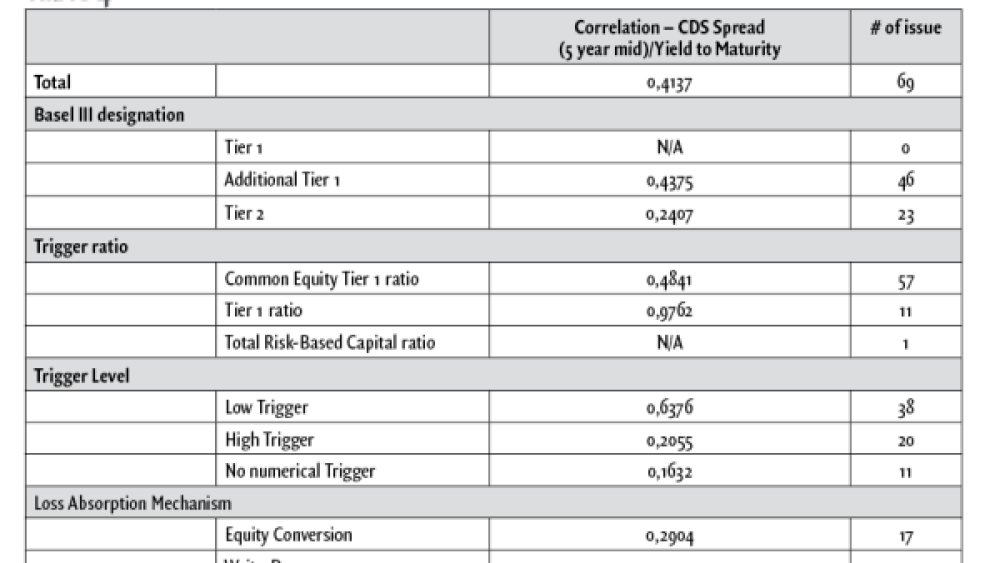

13.06.2016Contingent Capital Instruments (“CoCo”) have been issued by most of the Financial Institutions since January 2011 in order to address more stringent capital requirement initiated by the EU’s Capital Requirements Directive (CRD). This article examines CoCo design features and its pricing behaviour in the secondary market.

In the crisis aftermath, majority of analysis revealed and highlighted the high leverage level used by Financial Institutions in other words the lack of capital in the banking industry. This has quickly been presented as the prime lesson that Financial Institutions should hold much more capital in order to make banks safer in adverse situations. Consequently, policymakers such as the Basel Committee on Banking Supervision introduced new capital requirements which are supposed to prevent and ease resolution process in case of adverse situation would reoccur. Those new capital requirements for the ...

![[Web Only] Tarifs bancaires : les banques amortissent l’inflation [Web Only] Tarifs bancaires : les banques amortissent l’inflation](http://www.revue-banque.fr/binrepository/480x320/0c0/0d0/none/9739565/MEBW/gettyimages-968963256-frais-bancaires_221-3514277_20240417171729.jpg)