IPOs

Why European Firms Go Public

Créé le

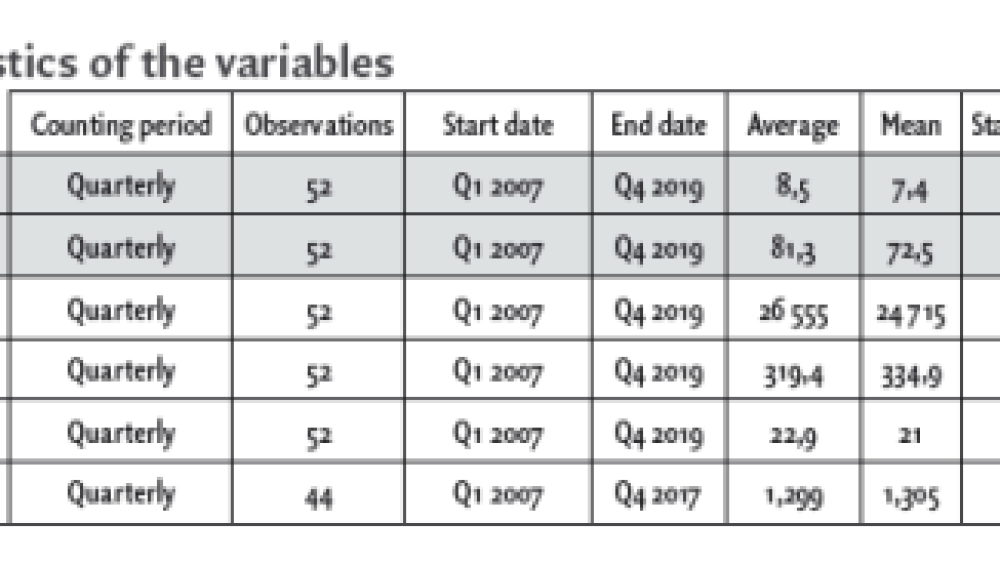

01.12.2020We defined and explained ten different factors that a firm considers in its decision-making process on whether to go public or not. For each factor, we described its impact on the IPOs in Europe over the 2007-2019 period and tried to find a proxy value in order to prove their link with the activity on capital markets. We took the most important factors and their proxy values and tested them in a statistical model.

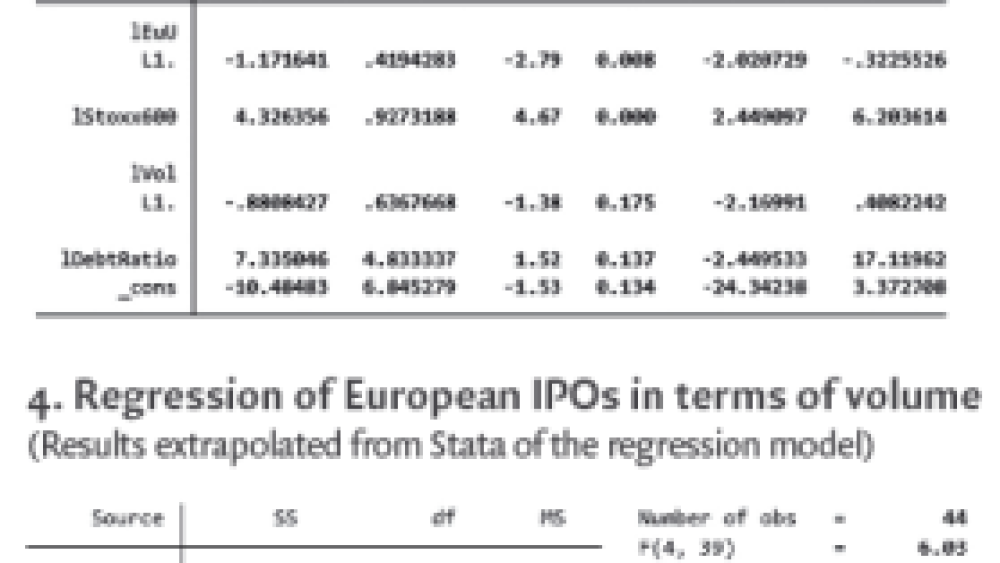

We find strong support for theories that link positive market conditions with the timing of IPOs, and therefore proof for the theory of the ‘window of opportunity’. Secondly, we find proof that links uncertainty and market volatility with IPO activity in Europe. We also find moderate empirical evidence for the substitution of equity financing by debt financing through the analysis of the European corporate debt ratio.

Thirdly, we find evidence to support that the emergence of bond markets and private equity has a negative effect on IPO activity since it offers an alternative for raising capital on the stock exchange.

Lastly, the evidence we found suggests that the decision-making process of a firm is a complex one, and can not be explained by a single of these factors, but is always a costs versus benefits matrix that depends on the firms size, age, leadership, as well as the political environment and legal system in its country of origin.

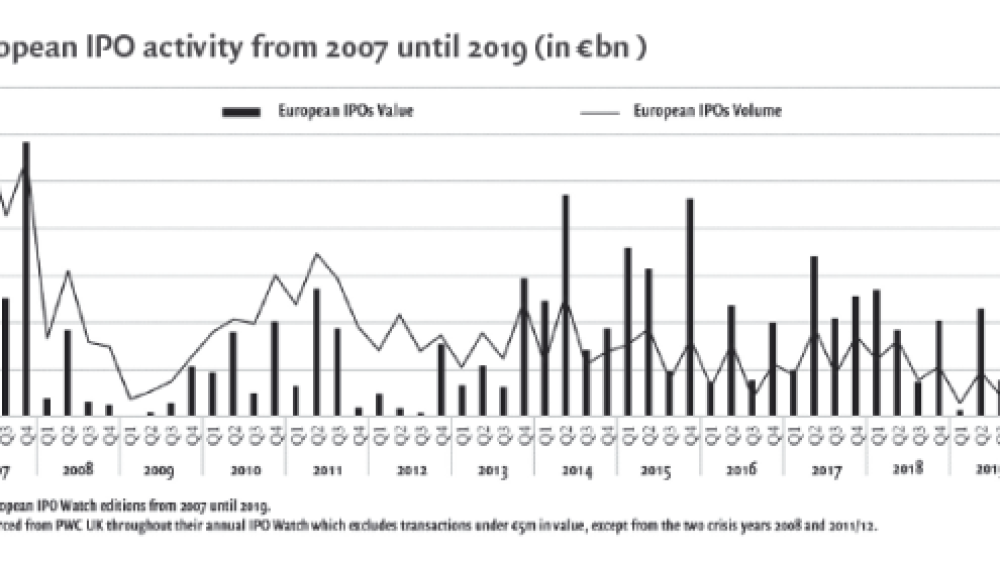

European initial public offering (IPO) activity has been relatively volatile over the last economic cycle. [1] The peaks, both in volume and value, of the pre-crisis year of 2007 have not been attained throughout the latter part of the cycle. An all-time high was reached in the fourth quarter of 2007 with more than € 29bn in value through 235 IPOs. The worst years for IPOs were during the aftermath of the 2008 global financial crisis and the 2011 European sovereign debt crisis with almost no significant initial public offerings.

The reasons behind the volatility of IPO activity are numerous ...