Financial instruments

“What are the determinants of corporate perpetual bond issuances?”

Créé le

29.05.2017-

Mis à jour le

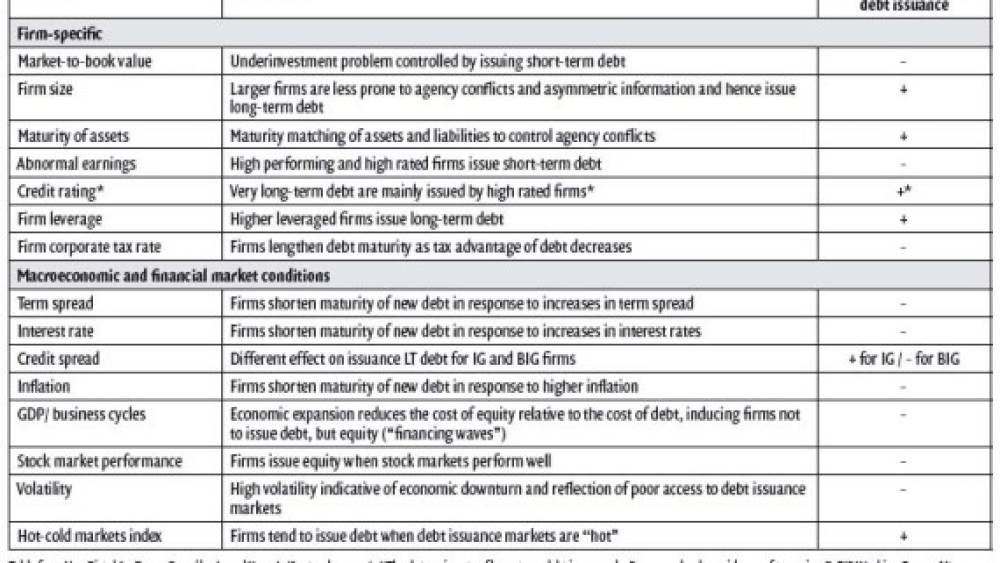

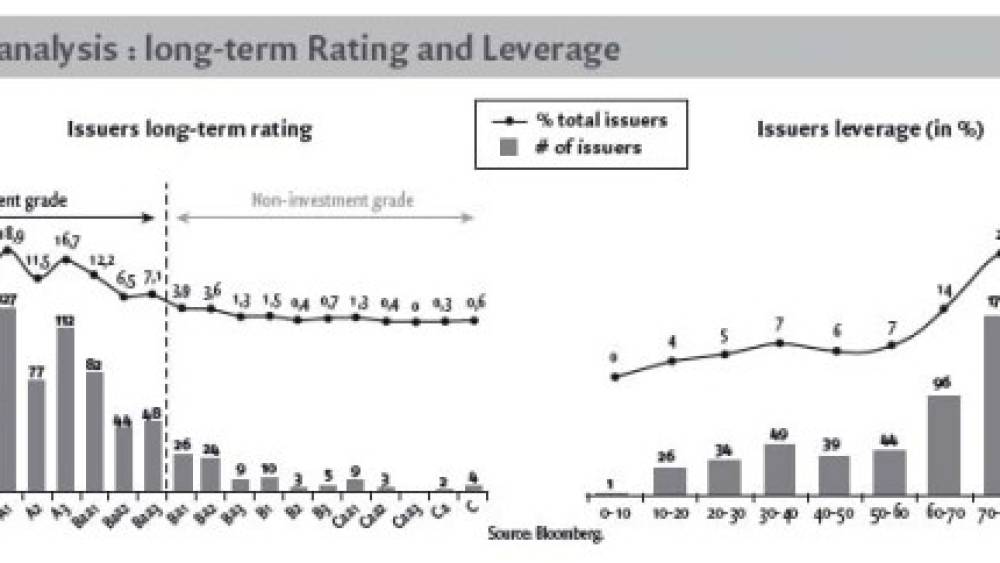

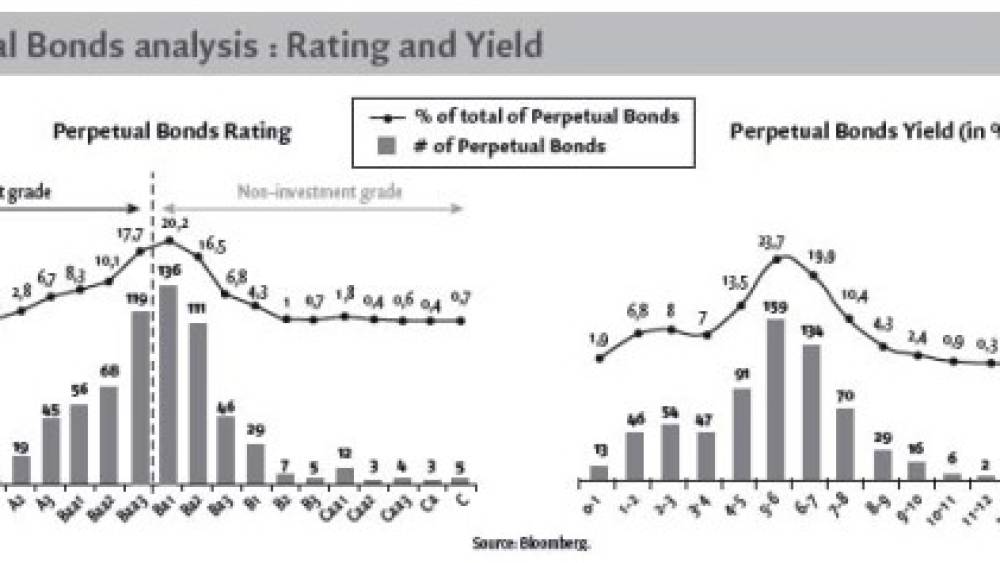

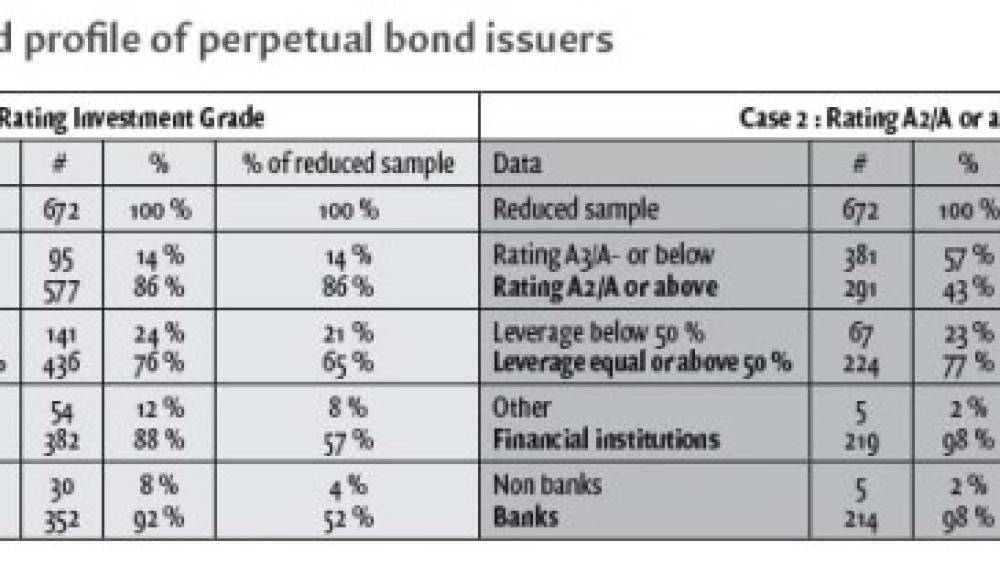

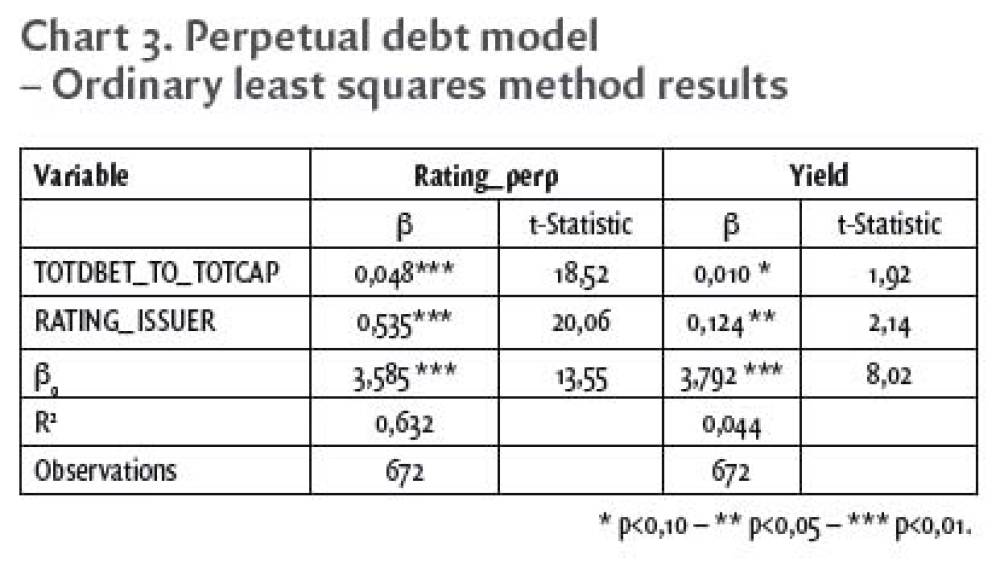

09.06.2017Perpetual bonds have become an alternative and often used capital raising instrument by corporates and banks. This paper aims at presenting these instruments, the determinants of their issuances, as well as drawing the standard profile of issuer.

The first perpetual bond in history was issued in 1648 by a Dutch water board to finance the construction of a dike system, and the bond is currently held by Yale University in the United States and still pays interests. Nowadays, perpetual bonds have become an alternative and often used capital raising instrument by companies. They are notably frequently associated with banks or financial institutions willing to improve their capital ratios but are also issued by corporates looking for non constraining funds. Thus, as of January 7, 2017, Bloomberg was recording a total outstanding perpetual bond ...

![[Web Only] Tarifs bancaires : les banques amortissent l’inflation [Web Only] Tarifs bancaires : les banques amortissent l’inflation](http://www.revue-banque.fr/binrepository/480x320/0c0/0d0/none/9739565/MEBW/gettyimages-968963256-frais-bancaires_221-3514277_20240417171729.jpg)