Investment

The Influence of the Strategy on Structure and Organizational Elements of CVC Activities

Créé le

02.12.2020The most vital division of the framework is the one between strategic and financial investors, this difference marks the relationship between investor and start-up with a different knowledge stream.

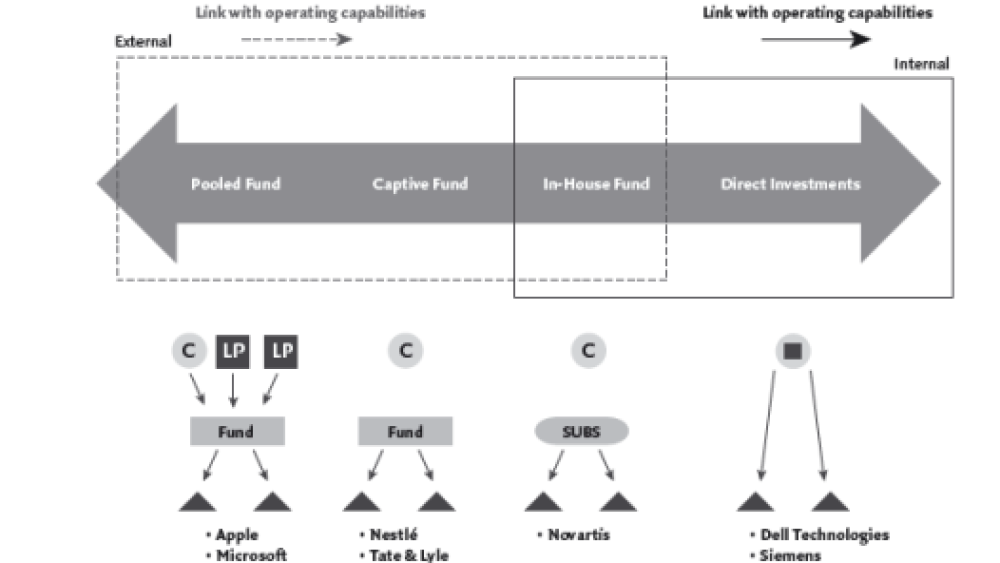

This article summarizes my extensive research into corporate venture capital (CVC), a specific form of external corporate venturing (CV). CVC can be defined as equity or equity-related investment made by a corporation or its investment entity into a high-growth, high-potential, and privately-held business. More precisely, I investigated how structural and organizational elements of a CVC investment are influenced by the strategy of the investing company. Through this research, an attempt is made to provide a framework for CVC investors to help them structure and organize their CVC activities according ...

![[Web Only] Tarifs bancaires : les banques amortissent l’inflation [Web Only] Tarifs bancaires : les banques amortissent l’inflation](http://www.revue-banque.fr/binrepository/480x320/0c0/0d0/none/9739565/MEBW/gettyimages-968963256-frais-bancaires_221-3514277_20240417171729.jpg)