Market Efficiency

The Impact of Reputation Attributes on Stock Performance

Créé le

06.06.2014-

Mis à jour le

17.06.2014This research provides conclusions regarding the validity and limitations of efficient market theory, by developing risk-return analysis of five specific reputation components : Innovation, Social Responsibility, Management Quality, Long Term Investment and Financial Soundness.

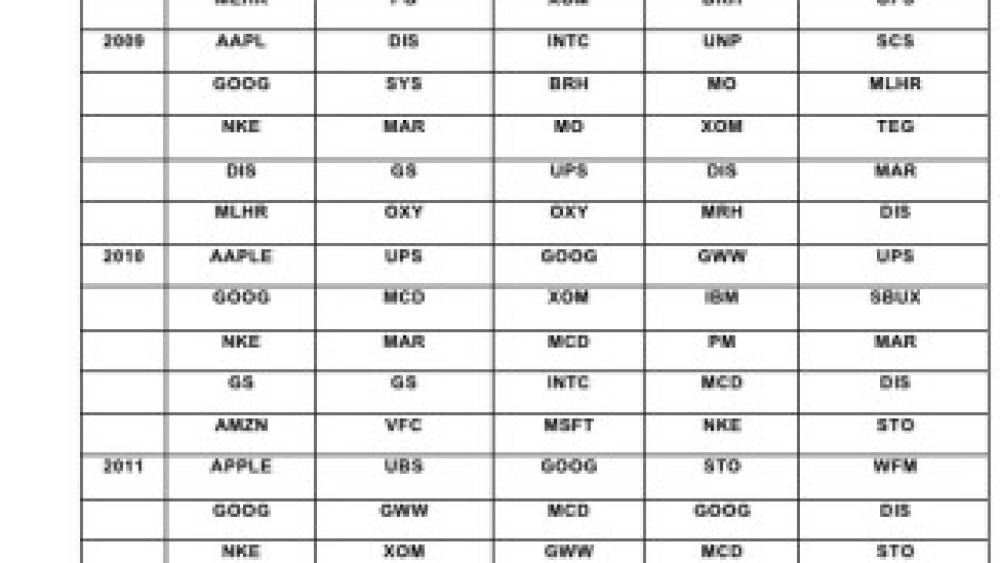

Efficient market theory has been a leading academic model of market behaviour in the last decades. However, many studies and investors have managed to challenge this theory, supported on research and practical evidence often called “financial anomalies”, among which reputation finds abundant validation. To contribute further with this discussion, this research develops on the risk-return analysis of five specific reputation components: Innovation - Social Responsibility - Management Quality - Long Term Investment - Financial Soundness.

The study will feed on the data from the Fortune ...