Biotechs and capital structure

The impact of a biotechnology firm’s approval to market a drug on its capital structure

Créé le

30.05.2017-

Mis à jour le

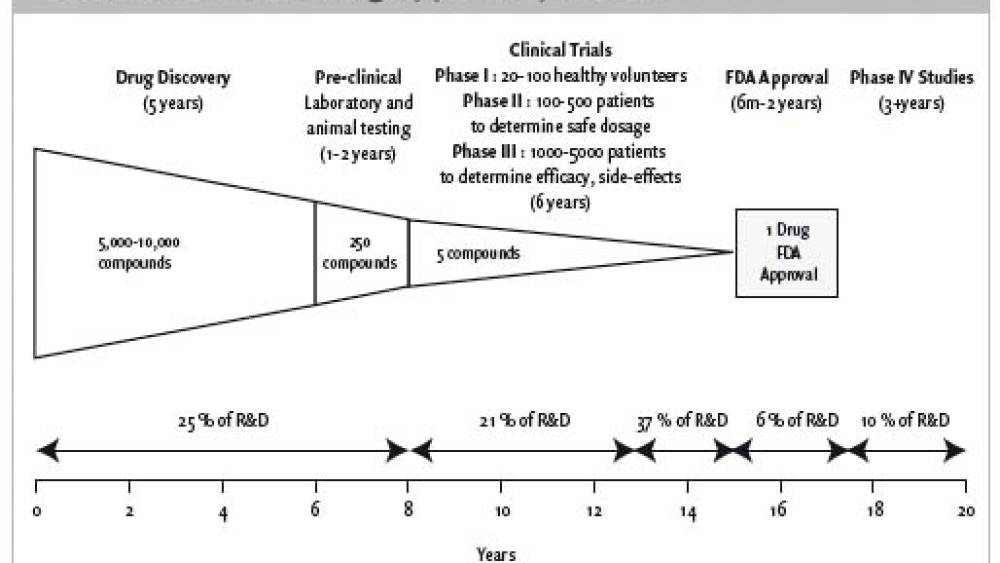

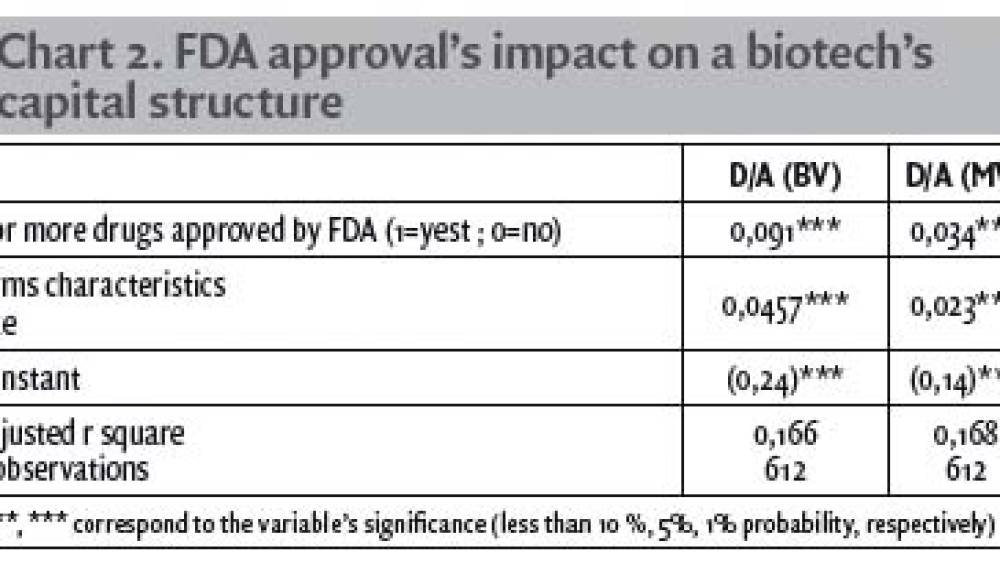

09.06.2017This paper aims at depicting the extent to which the US Food and Drug Administration (FDA) authorisation to launch a drug on the market has an impact on the status of a biotech, his financing decisions and more specifically its capital structure. Through the case of biotechnology firms listed on the Nasdaq Biotechnology Index (NBI).

According to a study by PWC (2011), the birth of the biotechnology industry dates back to 1980, when the US Supreme Court, allowed man-made, genetically engineered microorganisms to be patented. The OECD defines biotechnology as “the application of science and technology to living organisms to alter living or non-living materials for the production of knowledge, goods and services“. The last twelve months revenue generated by the biotechnology industry as of September 2016 was estimated at US$104 billion while the FDA approved 45 new drugs in 2015, the largest number since 1996, according ...