Asset management

Green ETFs: An Econometric Study on Performance and Volatility Dynamics

Créé le

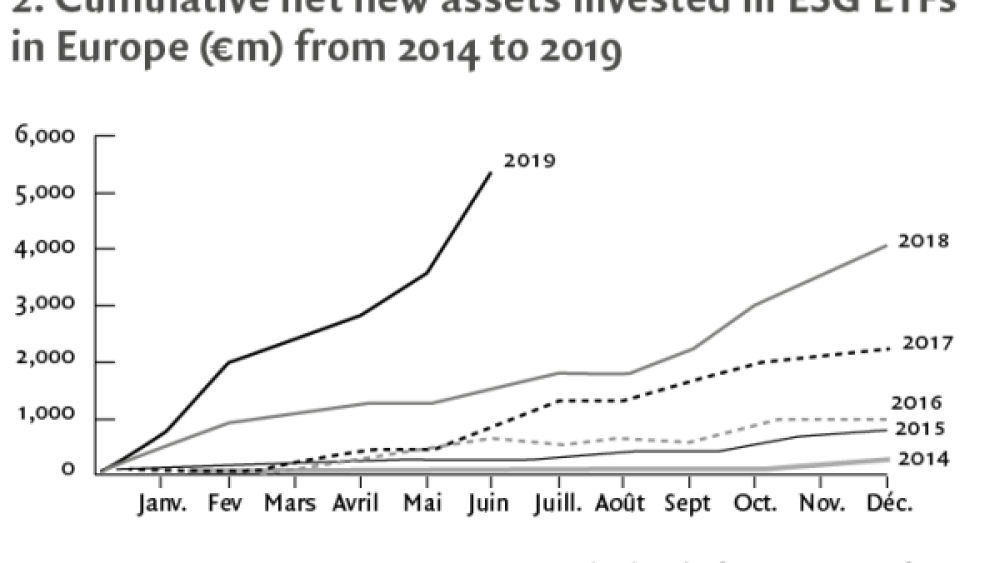

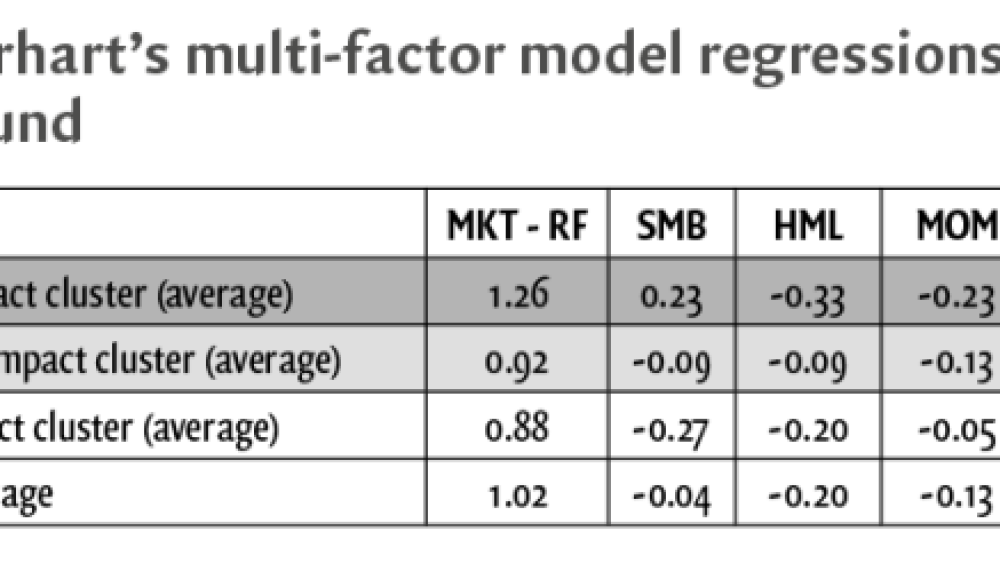

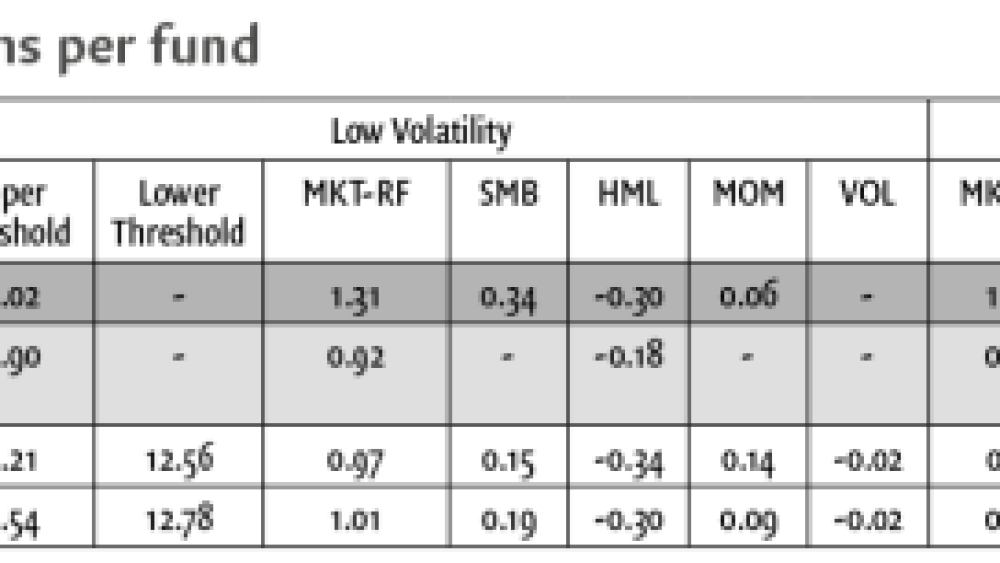

29.06.2020This work aims to analyze the performance and volatility dynamics of green exchange-traded funds, defined as those comprising stocks with a positive environmental impact. The paper uses a statistical sample of funds data on returns from January 2015 to July 2019.

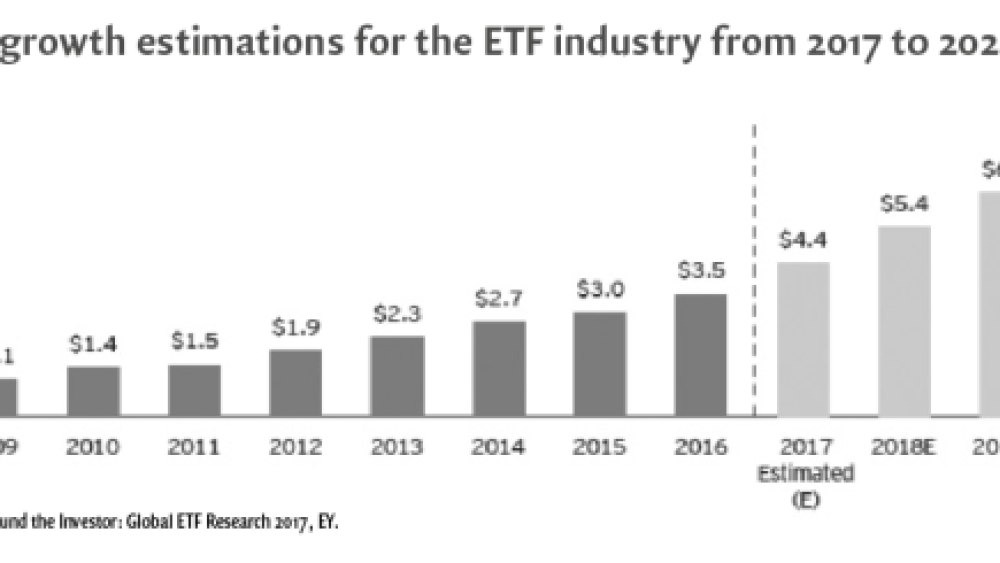

The ETF industry has seen immense growth in the past decade and continues to defy average statistics for any previous financial instrument. However, the industry can no longer rely on lower costs and quick liquidity to rival traditional mutual funds. This is where Green ETFs come in place, as ESG investing becomes paramount to investors and asset managers alike. This work aims to analyze the performance and volatility dynamics of such exchange-traded funds, defined as those comprising stocks with a positive environmental impact. The paper uses a statistical sample of funds data on returns from ...

![[Web Only] Tarifs bancaires : les banques amortissent l’inflation [Web Only] Tarifs bancaires : les banques amortissent l’inflation](http://www.revue-banque.fr/binrepository/480x320/0c0/0d0/none/9739565/MEBW/gettyimages-968963256-frais-bancaires_221-3514277_20240417171729.jpg)