The Economics of Collateral-Chains in the Financial System

Créé le

30.12.2011-

Mis à jour le

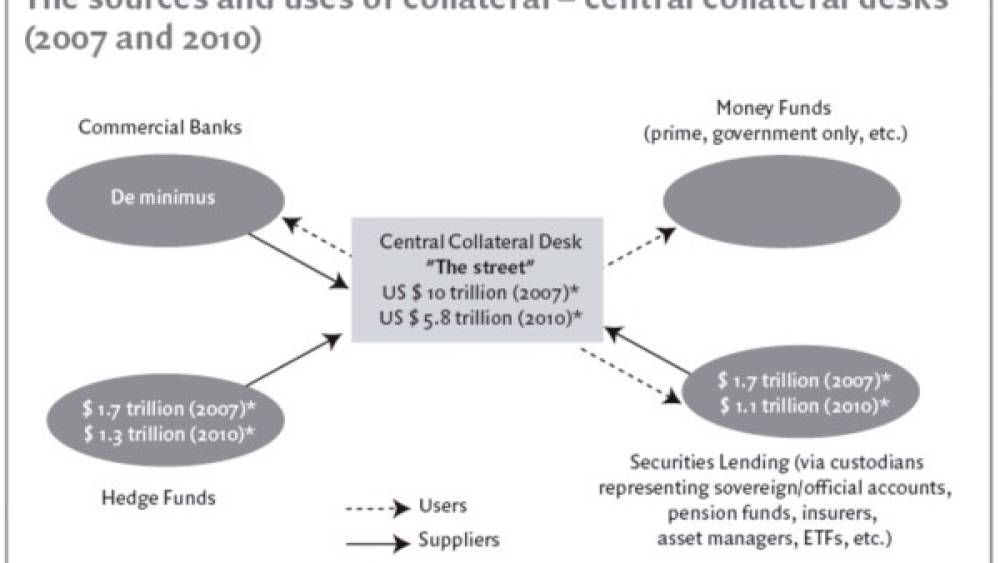

27.01.2012Post-Lehman, there has been a significant decline in the source collateral for the large banks that specialize in intermediating pledgeable collateral. Since good collateral can be reused in financial markets, the overall effect (i.e., reduced ‘source’ of collateral times the velocity of collateral) may have been a $4-5 trillion reduction in collateral. This decline in financial lubrication likely has impact on global financial stability and the conduct of global monetary policy.

The ‘supply’ of pledged collateral is typically received by the central collateral desk of banks that re-use the collateral to meet the ‘demand’ from the financial system. The key providers of primary (or source) collateral to the ‘street’ (or large banks) are: (i) hedge funds; (ii) securities lending (via custodians) on behalf of pension funds, insurers, official sector accounts etc. and (iii) commercial banks that liaise with large banks–see figure below. The securities they hold are continuously re-invested to maximize returns over their maturity ...