Cumulative Abnormal Return

Do Chinese cross-border mergers and acquisitions create value in the context of the US-China trade war?

Créé le

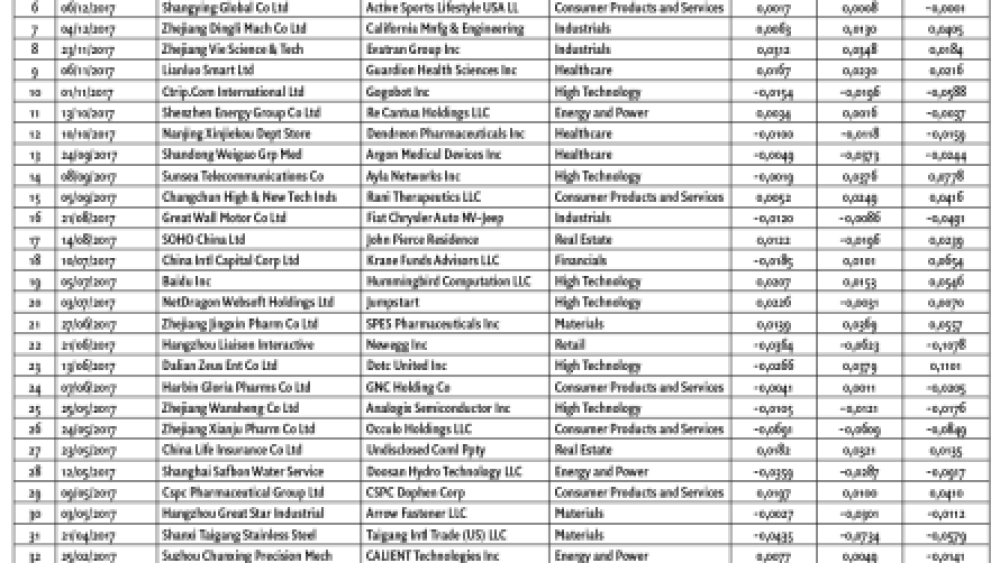

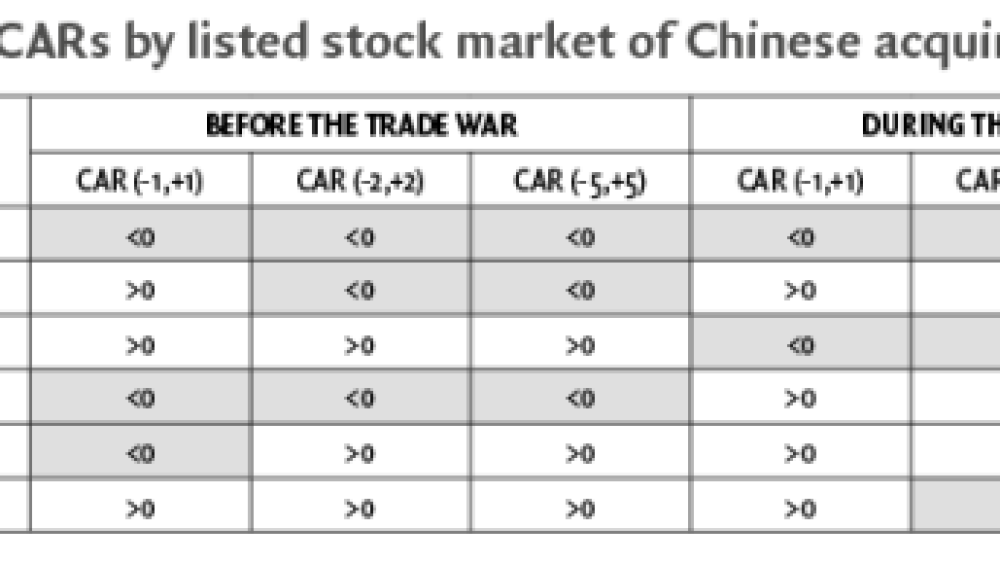

19.06.2020In the context of the US-China trade war since 1st March 2018, we aim to investigate if Chinese cross-border Mergers and Acquisitions create positive value by calculating the Cumulative Abnormal Return (CAR) for Chinese acquirors investing in the US and in Europe (France, UK and Germany) before and during the trade war.

In 2018, the Trump administration announced tariffs on approximately $283 billion of U.S imports, and these tariffs rate between 10% and 50%. As one of the U.S. trading partners, China retaliated with tariffs averaging 16% on approximately $121 billion of U.S. exports. In this context of the US-China trade war since 1st March 2018, we aim to investigate if Chinese cross-border Mergers and Acquisitions create positive value for Chinese publicly listed acquirors in the US and in Europe (France, UK and Germany) before and during the trade war. For this investigation, an event study analysis was conducted ...