FX Market and Machine Learning

Direct Listing : a viable alternative to traditional IPOs ?

Créé le

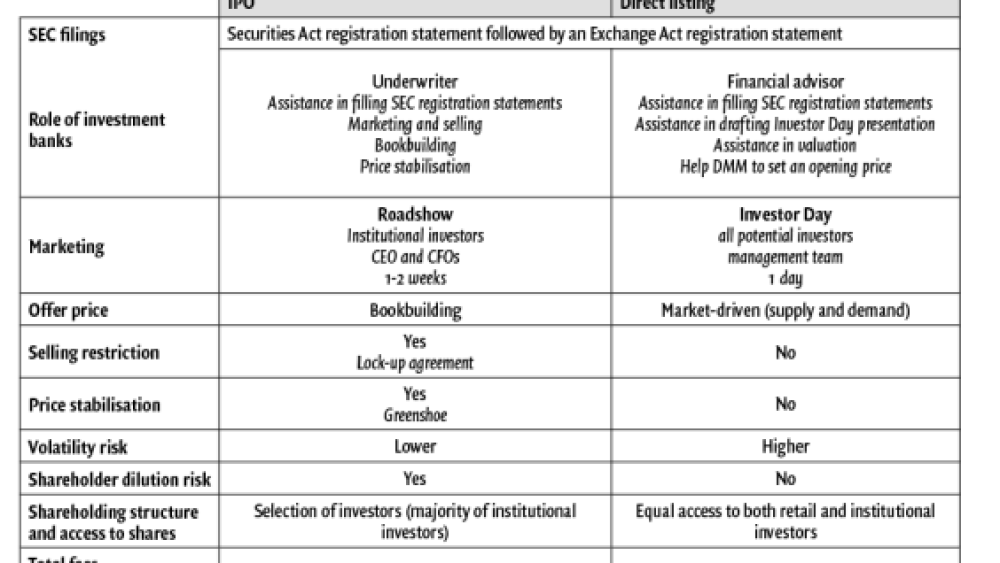

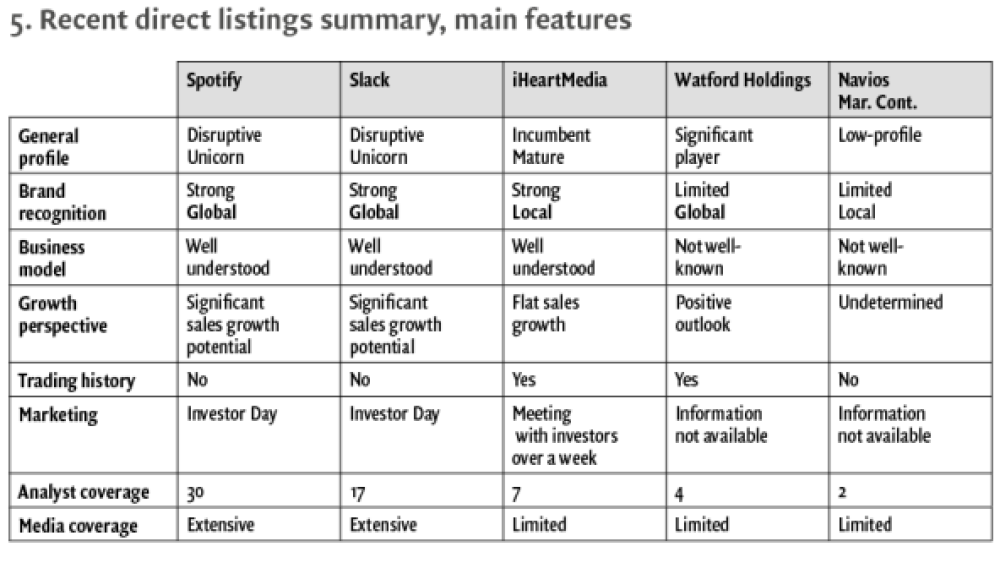

19.06.2020The direct listing presents many attractive features for companies willing to go public at lower costs while keeping control over their listing process and avoiding significant involvement of investment banks. It is not a novel instrument, but it has received massive media coverage since Spotify listed its shares on the NYSE in April 2018. Did Spotify initiate an actual trend that is set to last? If the latter is true, the direct listing could disrupt the traditional IPO market and become a viable alternative to companies willing to go public.

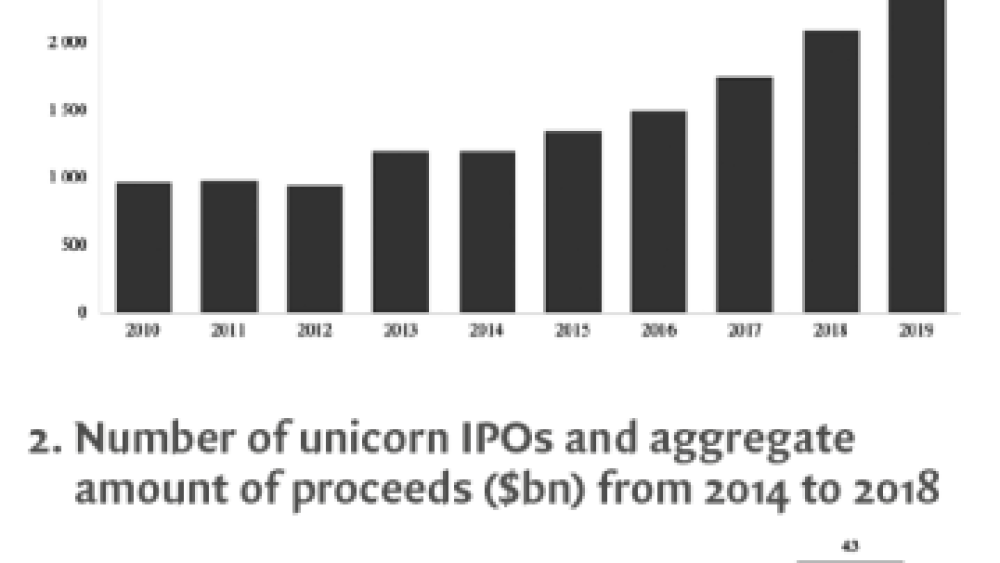

The IPO market is undergoing a significant change with the increasing interest in alternative methods to the traditional IPO, which is intermediated by investment banks. The main catalysts driving this trend are (i) companies’ frustration regarding the costly and lengthy traditional IPO process, (ii) companies staying private longer, and (iii) unprecedented access to financing through private markets. These current financing trends and the shift in companies’ needs and objectives support an increasing interest in alternatives to the traditional IPO process.

A growing interest in IPO ...

![[Web Only] Tarifs bancaires : les banques amortissent l’inflation [Web Only] Tarifs bancaires : les banques amortissent l’inflation](http://www.revue-banque.fr/binrepository/480x320/0c0/0d0/none/9739565/MEBW/gettyimages-968963256-frais-bancaires_221-3514277_20240417171729.jpg)