Private equity

The Appearance of Long-term LBO Funds: Market Opportunity or Correction?

Créé le

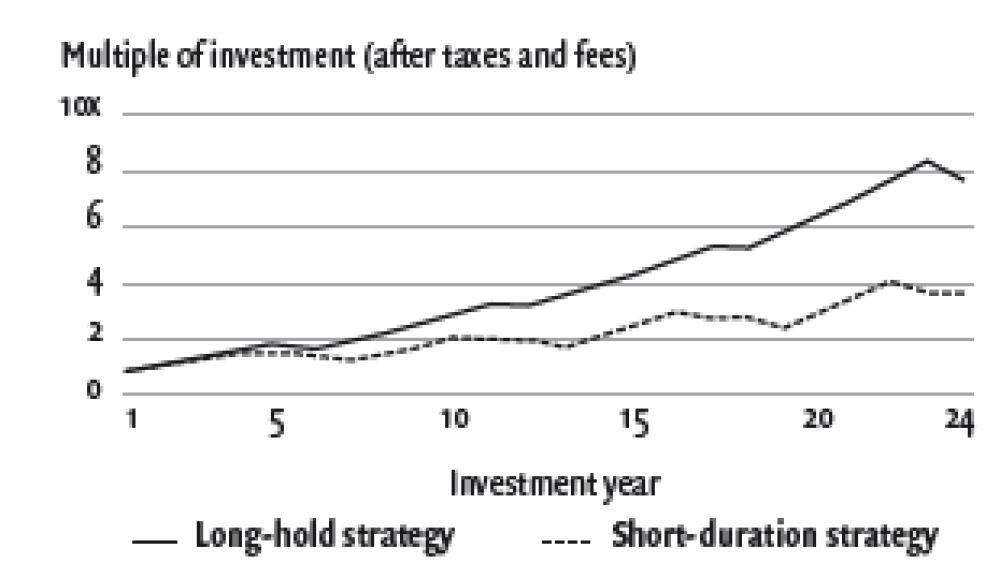

03.12.2020Long-term funds appear to have emerged as a sub-segment of LBO funds by tailoring room for itself in the closed and traditional landscape of global private equity. The emergence of these funds corresponds to a market opportunity sailing on an abundance of capital flowing into alternative assets.

The private equity industry faces many challenges, some new and others older, confirmed in their complexity. The global buyout dry powder is increasing each year reaching unprecedented amounts, the continuous increase in acquisition multiples, which significantly exceed historical levels, and the increasing competition between GPs are some descriptive elements of the current private equity landscape. Convinced of the attractiveness of the performance generated by top-quartile funds, institutional investors (LPs) are devoting an increasingly part of their allocation to this asset class. As a result, ...

![[Web Only] Tarifs bancaires : les banques amortissent l’inflation [Web Only] Tarifs bancaires : les banques amortissent l’inflation](http://www.revue-banque.fr/binrepository/480x320/0c0/0d0/none/9739565/MEBW/gettyimages-968963256-frais-bancaires_221-3514277_20240417171729.jpg)