Performance

Announcing Growth-induced Dividend Cut: Good News for Shareholders?

Créé le

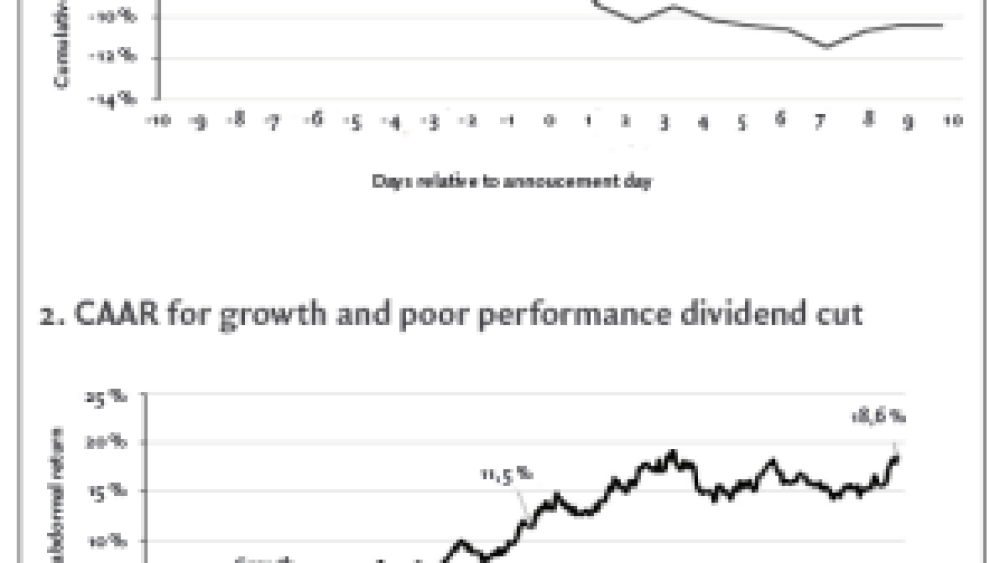

01.12.2020This article deals with the announcement of growth-induced dividend cuts in the short and long run to understand the shareholder value creation associated and compare these returns to companies announcing dividend cut as a result of poor performance.

Dividends have been subject to extensive debate amongst financial theorists in the past decades. When a company starts to generate earnings, the decision of paying dividends to shareholders or reinvesting the surplus in the business becomes crucial. Indeed, for investors, this decision conveys information about a firm’s expected future performance in order to ascertain the true value of the firm and to mitigate agency costs.

Up until now, most studies on dividend distribution have concluded that a change in dividend policy results in a reaction from market participants in the form of a change ...

![[Web Only] Tarifs bancaires : les banques amortissent l’inflation [Web Only] Tarifs bancaires : les banques amortissent l’inflation](http://www.revue-banque.fr/binrepository/480x320/0c0/0d0/none/9739565/MEBW/gettyimages-968963256-frais-bancaires_221-3514277_20240417171729.jpg)