Open API banking

A value chain revolution in Japan

Créé le

31.08.2018-

Mis à jour le

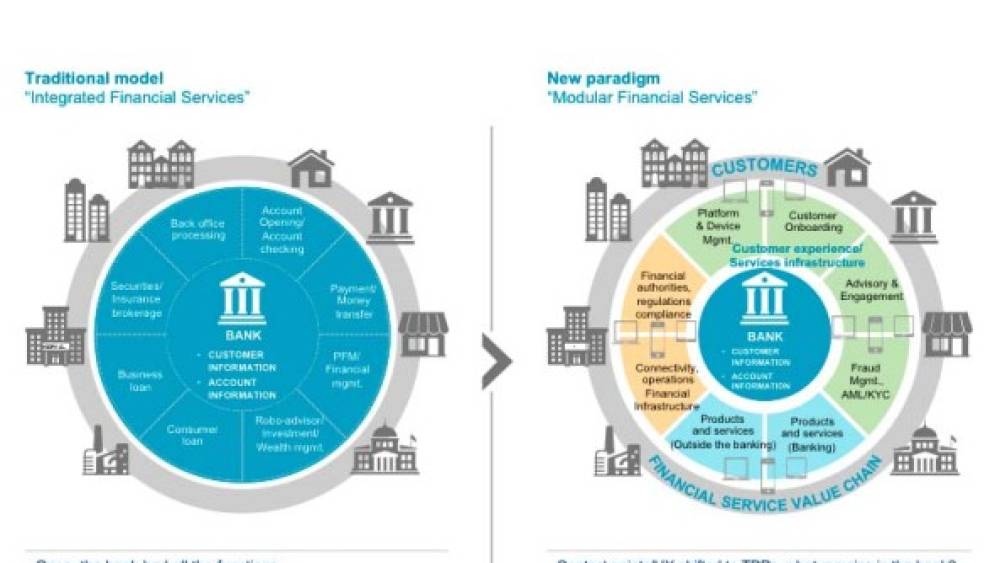

13.09.2018The open application programming interfaces (APIs) is a big trigger for the value chain revolution for the Japanese banks and FSIs. In May 2017, the Japanese financial industry steered to a new framework. The Amended Banking Act decided to introduce a registration system for Electronic Settlement Agency Service Providers, so-called “Third Party Providers (TPPs)” and to announce policies of collaboration between banks and TPPs. Measures concerning the promotion of open innovation at banks emerged as new regulations.

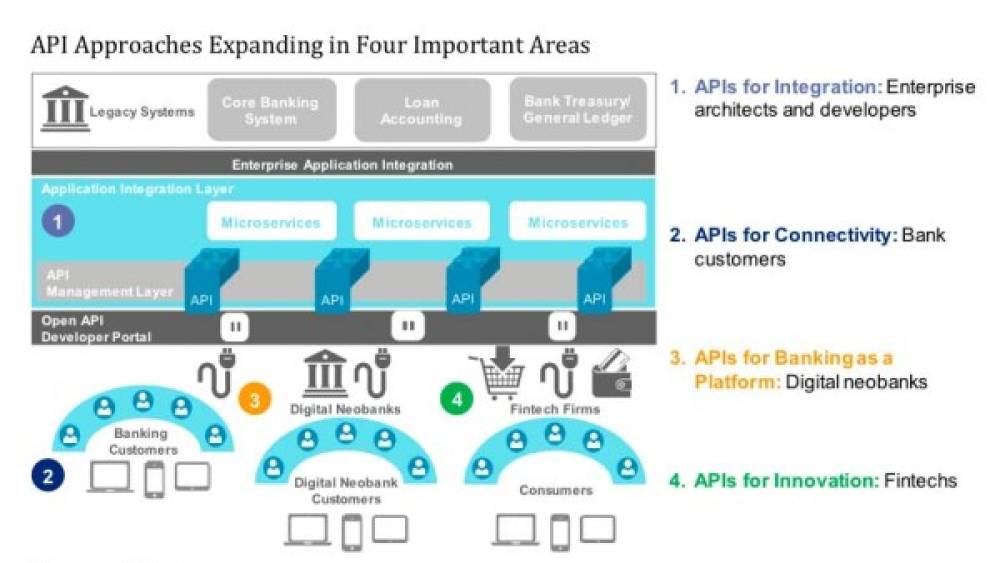

What kind of business benefits could be achieved if all of the existing API technologies were harnessed to their fullest potential? Also, in that case, what type of architecture would this entail? Figure 1 is a compilation of the best API practices through 2017. One can identify different kinds of API:

System Integration API: in addition to driving the enterprise application integration at banks among system designers and developers, this also offers a platform for the Open API Developer Portal; Connectivity API: control of exclusive connections for bank customers naturally eliminates various ...