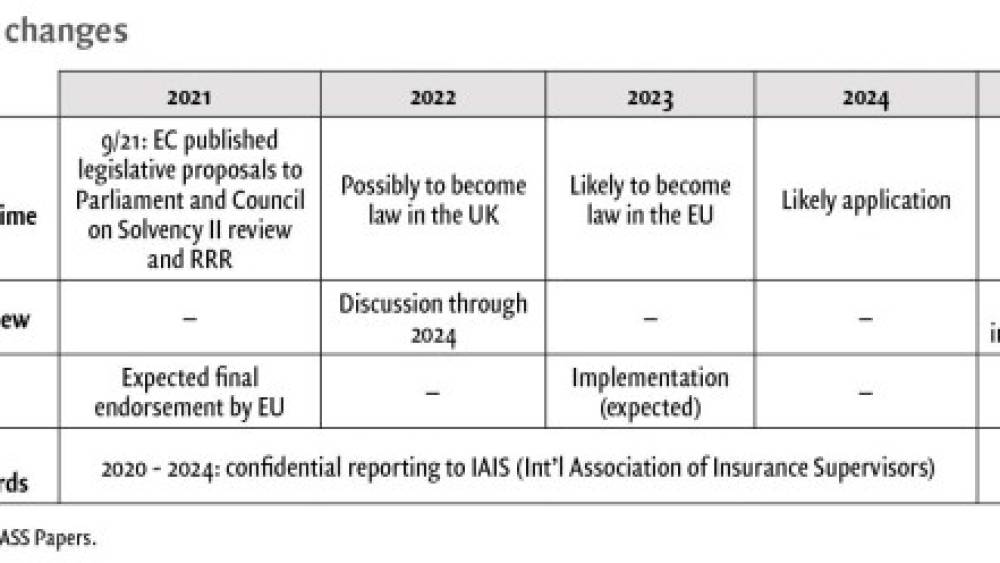

In a recent article, the rating agency Moody’s has highlighted upcoming regulatory changes: Recovery and Resolution Regime, Solvency II review, IFRS17 to be implemented in January 2023, International capital standards.

First and foremost, we believe that the Solvency II review and the Recovery and Regulatory Regime are probably the most impactful from a regulatory perspective. The implementation of IFRS17 will likely add opacity in terms of analysing and assessing European insurance companies.

The UK Government has recently proposed reforms that include a substantial reduction in the risk margin, the widening of assets eligible for the matching adjustment portfolio and a “major cut” in the EU-derived regulations which make up the current reporting and administrative “burden”.

Timing - Recovery and Resolution Regime

The proposed Directive will now become under review by the different stakeholders. Once published in the Official Journal of the European Union, it will become effective on the twentieth day following this publication. Reasonably, we would expect this to happen around 2024.

Each individual state will then have to transpose this new Directive and possibly apply transitional measures if needed. We would expect another couple of years post 2024, i.e. leading to an implementation in the region of 2026.

Surprisingly, assuming the above materialises, this would come at the end of the 10-year transitional measures under Solvency II.

What are we talking about? The content

The key subjects the Commission plans to make changes are (i) long-term equity investments, (ii) risk margin, (iii) volatility adjustment, (iv) matching adjustment, (v) extrapolation (vi) interest rate and last but not least (vii) resolution regime.

Proposal (i) to (vi) will likely release capital

According to the Financial Times’ article EU rule change offers insurers €90bn capital boost published on 22 September 2021, “the proposed changes include lowering the capital requirements associated with equity investments, including when stock markets are falling; and amending the so-called volatility adjustment, so that swings in asset prices have a smaller impact on solvency. The commission said it also planned to adjust the risk margin, a capital buffer, and to exclude more smaller companies from the directive”. Given the importance of assets under management by European insurance companies (above €10tn), the implementation of the abovementioned proposals could lead to the release of as much as €90bn of capital in the short-term according to the Financial Times.

Indeed, the first six points on which the Commission plans to make change (highlighted above) aim at releasing the insurers’ excess of capital.

Under the long-term equity investment, the Commission anticipates that the proposed simplifying conditions for this asset class such as infrastructure funds would lead in the region of €10bn of capital under the standard formula. The change to the risk margin aims at reducing its volatility in particular to interest rates; the Commission also aims at reducing the cost of capital to 5% from 6%. The proposed changes to volatility adjustment would allow a higher percentage of the risk-adjusted spread to be include in the volatility adjustment.

We think this aims at aligning the benefit of the Volatility Adjustment to matching adjustment levels. Under the proposed Matching Adjustment, which is predominantly used by UK and to a much lower extent Spanish and some Benelux insurance companies, the Commission aims at recognising diversification benefits between the portfolio under the Matching Adjustment and the rest of the risks identified under Solvency II. Finally, the Commission plans to amend the methodology under which the extrapolation of the risk-free rate structure is performed as well as the recalibration of the interest rate risk module leading to adjusting the required capital for interest rate risk.

As at this stage the new proposed amendments would release some capital, the Board of Directors of insurance companies will have to deal with this environment. Would they propose to the insurer’s shareholders to return this excess of capital or instead take the opportunity to embark into new acquisitions leading to possible increasing concentration among the insurance sector?

We could see both outcomes.

Clearly, if the proposed amendments were to release as much as €90bn of capital in the short-term as highlighted by the Financial Times, it looks like a “free lunch” for an aggressive acquisition strategy for insurance companies benefiting from an already strong profitability level with minimum constraints from their shareholders. In contrast, those insurers with relatively weak profitability levels will likely be tempted to return their excesses of capital to their shareholders.

Proposal (vii) will empower local regulators in case of insolvency but put at risk all creditors including policyholders

Neither the Solvency II nor the UK regulatory regime feature resolution rules for insurance companies. Management of European insurance companies would argue that, relative to banks for example, European insurers are more resilient given their strong liquidity position thanks to the reverse cycle of production that characterises the sector. Additionally, when things go wrong, we would rather put into run-off the insurer leaving some flexibility to deal with the insolvency state of the company.

This argument is supported by the probability of default of European insurers. According to the three major rating agencies in Europe, namely Fitch, Moody’s and S&P, the probability of default of European insurance companies stands at the same level as European states. IN the current environment, some management would even argue that the firms they manage are more resilient than European states given the recent increase in debt.

In contrast, European banks do have a regulatory framework for a recovery and resolution regime, which was introduced by the Bank Recovery and Resolution Directive 2014. Pretty much in line with Solvency II, last summer, the UK government published a consultation which sets the proposed amendments to the standard corporate insolvency procedures for insurers in financial difficulties (a run-off or transfer of insurance business, a scheme of arrangement or the administration or winding up of the insurer). It is not sure at this stage if the PRA would follow Solvency II framework or go for its own insolvency framework. In its current version, the amendments clarify that almost all unsecured debt of the insurers could be written-down/up, allow the write-down powers to be exercised prior to the company being in default per se and therefore give power to the regulator to intervene at his will and introduce a new write-down manager role.

The proposed amendments under Solvency II are 1. the establishment of insurance resolution authorities equipped with a minimum harmonised set of powers, 2. the ability of the local regulator to decide when it intervenes when an re/insurance company is likely to fail or a resolution action is necessary in the public interest and 3. resolution tools (write-down/up of capital and debt instruments on the basis of their hierarchy, sale or transfer of the company and temporary moratorium on payment of claims under insurance policies).

So what?

First and foremost, we think that the most important consequence under the proposed amendments under Solvency II is the fact that potentially policyholders could see the value of their claims being written down. The waterfall among the different creditors is not changed. Although we think that the probability of this scenario being implemented is very low, it comes as a surprise given the fact that collectively policyholders to lend money to be insured.

Second, it is not clear at this stage when the regulator would intervene. It is our understanding that an insurance company becomes insolvent when it fails to pay its creditors because of liquidity problems and/or when it reaches its Minimum Capital Requirement under Solvency II. With the exception of a few players whose risk profiles are skewed towards natural catastrophes or sudden increase in lapses for Life insurance companies, we think that illiquidity risk is quite remote. Instead, we would rather expect insurers at risk those suffering from a sharp fall in their Solvency II ratios because of (i) a high exposure to capital markets, especially for the smaller and less diversified ones or (ii) a sharp increase in business leading to potential undervalued reserves, or (iii) undiversified insurers exposed to peak risks (e.g. COVID-19). Additionally, we could argue that the intervention of the local regulator could potentially come in opposition to the civil corporate court. For example, we could possibly see examples where the local regulator declares insolvent the insurance company while the local civil corporate court would not have acted the company’s insolvency.

Third, the proposed amendments will change the risk profile of debt instruments. Under the current Solvency II regulation, only the Restricted Tier 1 debt instrument could be written down and/or converted into equity. In the future, this write-down/up mechanism would also be applied to Tier 2 and Tier 3 debt instruments in some (extreme) circumstances.

Fourth, from a pragmatic approach, since all capital instruments could be written down, we are not sure how the mechanism would apply to the reconciliation reserve (Tier 1 capital) under Solvency II, which in essence represents the present value of expected profit included in future premiums. As the Life insurance company starts becoming insolvent, the value of its reconciliation reserves would decline. Would that mean that expected profits included in future premiums would be pledged or securitsed? How?

Fifth, by writing down capital instruments such as the reconciliation reserve and debt instruments, the regulator would implicitly speed up the insolvency of the insurance company. The capital and debt instruments would be reduced to nil and consequently reduce the insurer’s eligible own funds. Everything else being equal, this would deteriorate the insurer’s Solvency II ratio.

A changing environment

While some players have claimed that the proposed amendments should be viewed as an evolution of Solvency II, we think it looks like as a big bang. Historically, the European insurance sector has shined by the low probability of default of its players because of the prudent man approach under Solvency I.

So far Solvency II has also demonstrated the resilience of the European insurance sector. A very good example can be found in the implications of Covid-19. In most cases, it has been a profit and loss event, not a solvency one.

Prospectively, if the proposed amendments were to be implemented, we think that insurance companies will likely rely on lower relative capital positions (because of the changed in the risk margin, matching/volatility adjustments for example) while at the same time creditors will be more at risk (because of the write down/up mechanism).

This situation would lead to more extreme cases we think. On the one hand, insurance companies will increasingly enjoy the benefits of high risk diversification enabling them to optimise their profitability and capital positions. On the other hand, smaller players will likely become more vulnerable.

This will also change the investment strategy of creditors we think. The funding cost of the most vulnerable will skyrocket and possibly funding will become more difficult for them. If all capital instruments could be written down/up under the new amendments, we expect investors to favour funding through equities instead of debt.

![[Web Only] Tarifs bancaires : les banques amortissent l’inflation [Web Only] Tarifs bancaires : les banques amortissent l’inflation](http://www.revue-banque.fr/binrepository/480x320/0c0/0d0/none/9739565/MEBW/gettyimages-968963256-frais-bancaires_221-3514277_20240417171729.jpg)